Using vwap on day trading

Volume weighted average price VWAP and moving volume weighted average price MVWAP are trading tools that can be used by all traders. However, these tools are used most frequently by short-term traders and in algorithm based trading programs. MVWAP may be used by longer term traders, but VWAP only looks at one day at a time due to its intra-day calculation.

Both indicators are a special type of price average which takes into account volume; this provides a much more accurate snapshot of the average price.

The indicators also act as benchmarks for individuals and institutions who wish to gauge if they got good execution or poor execution on their order. For a primer, see Weighted Moving Averages: Calculating VWAP The VWAP calculation is performed by the charting software and displays an overlay on the chart representing the calculations.

This display takes the form of a line, similar to other moving averages. How that line is calculated is as follows:.

It is likely best to use a spreadsheet program to track the data if you are doing this manually. A spread sheet can be easily set up. Attaining the MVWAP is quite simple after VWAP has been calculated. A MVWAP is basically an average of the VWAP values. VWAP is only calculated each day, but MVWAP can move from day to day because it is an average of an average. This provides longer-term traders with a moving average volume weighted price. If a trader wanted a 10 period MVWAP, they would simply wait for the first ten periods to elapse and then would average the first 10 VWAP calculations.

This would provide the trader with the MVWAP that starts being plotted at period To continue getting the MVWAP calculation, average the most recent 10 VWAP figures, include a new a VWAP from the most recent period and drop the VWAP from 11 periods earlier.

Apply to Charts While understanding the indicators and the associated calculations is important, charting software can do the calculations for us. On software that does not include VWAP or MVWAP, it may still be possible to program the indicator into the software using the calculations above.

For related reading, see Tips For Creating Profitable Stock Charts. By selecting the VWAP indicator, it will appear on the chart. Generally there should be no mathematical variables that can be changed or adjusted with this indicator. If a trader wishes to use the Moving VWAP MVWAP indicator, she can adjust how many periods to average in the calculation.

This can be done by adjusting the variable in our charting platform. Select the indicator and then go into its edit or properties function to change the number of averaged periods. Differences between VWAP and MVWAP There are a few major differences between the indicators which need to be understood. VWAP will provide a running total throughout the day.

What is a common strategy traders implement when using the Volume Weighted Average Price (VWAP)? | Investopedia

Thus, the final value of the day is the volume weighted average price for the day. If using a one minute chart, there are 6. MVWAP on the other hand will provide an average of the number of VWAP calculations we wish to analyze. This means there is no final value for MVWAP as it can run fluidly from one day to the next, providing an average of the VWAP value over time. This makes the MVWAP much more customizable.

It can be tailored to suit specific needs. It can also be made much more responsive to market moves for short-term trades and strategies or it can smooth out market noise if a longer period is chosen. VWAP provides valuable information to buy and hold traders, especially post execution or end of day. It lets the trader know if they received a better than the average price that day or if they received a worse price.

MVWAP does not necessarily provide this same information. For more, see Understanding Order Execution. VWAP will start fresh every day. Volume is heavy in the first period after the market open; therefore, this action usually weighs heavily into the VWAP calculation.

Intraday Support and Resistance - Using Volume -VWAP - Analysis Concepts - Labs - Education - TradeStation

MVWAP can be carried from day to day, as it will always average the most recent periods 10 for example and is less susceptible to any individual period - and becomes progressively less so the more periods which are averaged.

General Strategies When a security is trending, we can use VWAP and MVWAP to gain information from the market. If the price is above VWAP, it is a good intra-day price to sell. If the price is below VWAP, it is a good intra-day price to buy.

For additional reading, see Advantages Of Data-Based Intraday Charts. There is a caveat to using this intra-day though. Prices are dynamic, so what appears to be a good price at one point in the day may not be by day's end.

On upward trending days, traders can attempt to buy as prices bounce off MVWAP or VWAP. Alternatively, they can sell in a downtrend as price pushes up towards the line.

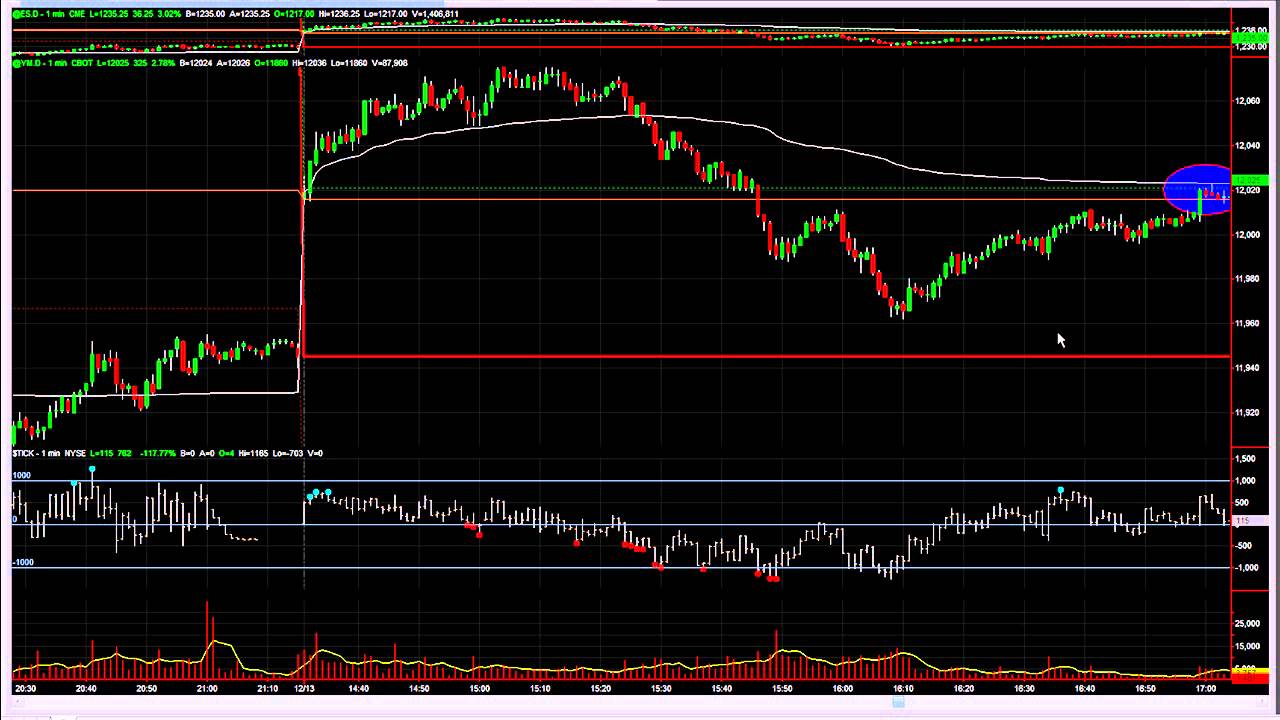

Figure 2 shows three days of price action in the iShares Silver Trust ETF SLV. As the price rose, it stayed largely above the VWAP and MWAP, and declines to the lines provided buying opportunities.

As price fell, they stayed largely below the indicators and rallies toward the lines were selling opportunities. This method runs the risk of being caught in whipsaw action. Alternatively a trader can use other indicators, including support and resistance , to attempt to buy when the price is below the VWAP and MWAP and sell when the price is above the two indicators.

At the end of the day, if securities were bought below the VWAP, the price attained is better than average. If the security was sold above the VWAP, it was a better than average sale price. Summary MVWAP and VWAP are useful indicators that have some differences between them.

MVWAP can be customized and provides a value which transitions from day to day.

VWAP, on the other hand, provides the volume average price of the day, but will start fresh each day. MVWAP can be used to smooth data and reduce market noise, or tweaked to be more responsive to price changes. If a trader sells above the daily VWAP, he gets a better than average sale price.

If he buys below the VWAP, he gets a better than average purchase price. On trending days, attempting to capture pullbacks towards the VWAP and MVWAP can produce profitable result if the trend continues. For related reading, also take a look at Pinpoint Winning Trade Entries With Filters And Triggers.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Trading With VWAP And MVWAP

Trading With VWAP And MVWAP By Cory Mitchell Share. Chart Analysis MVWAP may be used by longer term traders, but VWAP only looks at one day at a time due to its intra-day calculation. How that line is calculated is as follows: Choose your time frame tick chart, 1 min, 5 min, etc. Calculate the typical price for the first period and all periods in the day following. Typical price is attained by taking adding the high, low and close, and dividing by three: This is attained by continually adding the most recent TPV to the prior values except for the first period, since there will be no prior value.

This figure should always be getting larger as the day progresses. Keep a running total of cumulative volume. Do this by continually adding the most recent volume to the prior volume. This number should only get larger as the day progresses. Calculate VWAP with your information: This will provide a volume weighted average price for each period and will provide the data to create the flowing line which overlays the price data on the chart.

Microsoft Excel The appropriate calculations would need to be inputted. SLV with MVWAP 20 and VWAP in trending market, 10 minute chart Source: SLV with MVWAP 20 and VWAP in ranging market, 10 minute chart Source: Explore information about the VWAP, and learn how to calculate a security's VWAP and how to use the indicator to determine entry and exit points.

Volume weighted average price, or VWAP, is the average value of a stock traded over the course of a set time horizon, which is typically one day.

The first few moments of trading provide a lot of information. If a trader analyzes this information, it can give a lot of insight into the market's moves for the day. Measure the flow of intraday volume to estimate the emotional intensity of the crowd. The moving average is easy to calculate and, once plotted on a chart, is a powerful visual trend-spotting tool. Examine a few indicators and oscillators that could be used to complement the volume-weighted average price VWAP in a technical Learn how traders use the VWAP to calculate the average price weighted by volume and to analyze the momentum of trading on Find out about a common strategy that traders use with the volume-weighted average price, including the use of VWAP with Learn how traders use uptick and downtick volume with VWAP cross to identify trends and momentum and identify points of big Learn how a trader can use the volume price trend indicator as a strategy to identify changes in trends and how it can be Learn about time segmented volume TSV and how traders use this to identify buying and selling pressure and determining An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.