Why not to buy dividend paying stocks

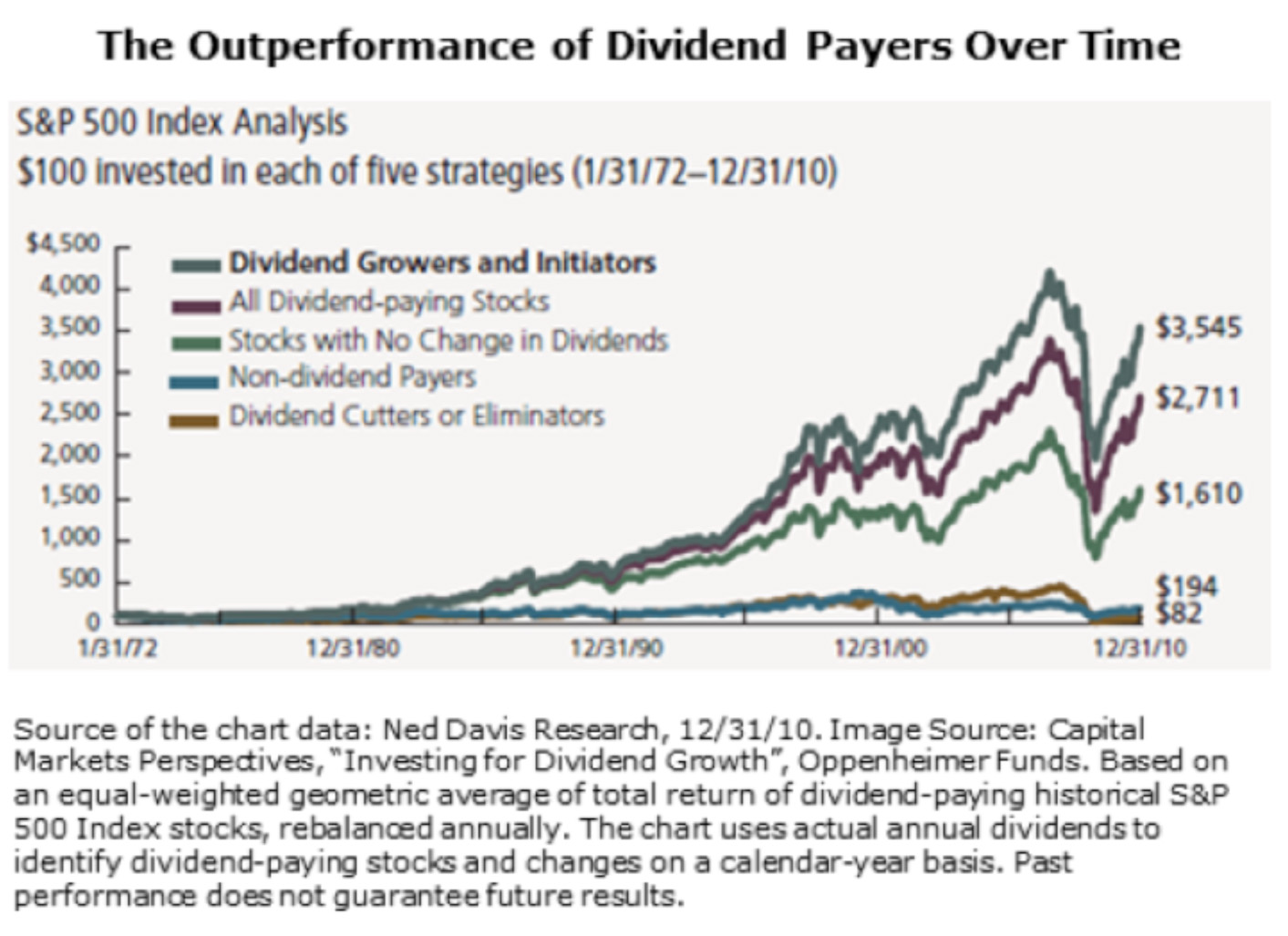

Founded in by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. Dividend stocks can be a great addition to your portfolio. On top of the cash they provide, dividends offer other benefits to long-term shareholders. Chief among them are the discipline that dividends enforce on companies' managements and the signaling power they provide regarding what those management teams really think about their companies' prospects.

Still, there's more to successful dividend investing than simply looking for the biggest dividends you can find.

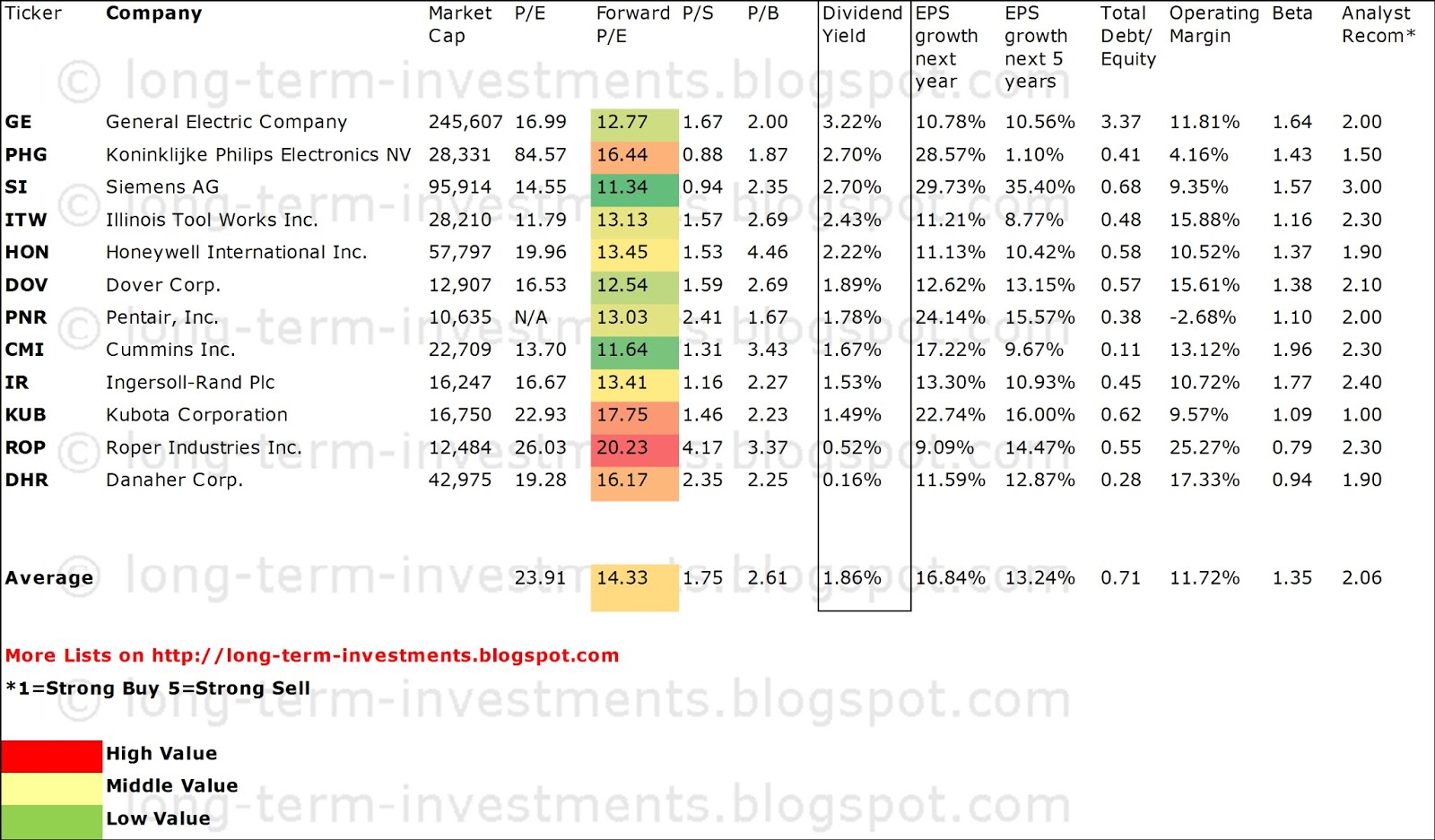

Keep reading to learn about some key things to look for in determining whether a dividend-paying company might deserve a place in your portfolio or whether it's one you might want to avoid. Dividend-paying companies within a given industry tend to have similar dividend yields, and a company with a very high yield compared with its peers may very well be what's known as a dividend trap.

What is the incentive to buy a stock without dividends?

That's a company that the market believes won't be able to maintain its dividend because of underlying financial troubles. STON , for instance. Yet it's losing money, and Moody's recently put a negative outlook on its debt rating, which already sits well in the "junk bond" range. Companies must prioritize their debt service ahead of their dividend payments, or else the bondholders can force a default and change of control. Contrast StoneMor Partners' yield with funeral services industry leader Service Corporation International NYSE: SCI , which is both profitable and trades with a mere 1.

Dividends are typically cash payments, and to make those payments, companies have to have the cash available. The only way that's even close to sustainable is for the companies to earn that money from their operations and then pay a portion of those earnings over to their shareholders. A company's "payout ratio" measures how much of a company's earnings get paid to shareholders from its dividend.

Take fast-food titan McDonald's NYSE: After all, companies need some flexibility to make sure they can cover unexpected expenses as well as their growth plans.

The Value of Stocks without Dividends

That said, there are some companies in specialized industries that frequently pay out above that level, but they are the exception, rather than the general rule.

Dividend-paying companies frequently attempt to increase their dividends over time as the profitability of their businesses allows. Canadian pipeline giant Enbridge NYSE: What gives Enbridge the confidence to announce that goal is that its primary business is moving energy around through pipelines, making it essentially an energy toll road. As the political flak over things like the Keystone XL pipeline expansion shows, it's hard to get approval to build pipelines.

Once that approval is granted, it still takes a lot of capital to actually build. That combination gives existing pipeline operators such as Enbridge a fairly high level of confidence in its future earnings growth potential. In addition, Enbridge recently completed the purchase of U. Dividend stocks whose payouts are well covered by their earnings and that have the opportunity to increase their dividends over time can play an excellent role in your portfolio.

Just make sure you're not overly tempted by high-yielding dividend traps. It's the total package that matters, not just the current yield. Instead, focus on fundamentally strong businesses with the operating strength to maintain their dividends and enough buffer to handle the unexpected twists the economy throws their way.

That way, you'll be more likely to own the strong companies that can make dividend stock ownership an ultimately profitable endeavor. Chuck Saletta owns shares of McDonald's and his wife owns shares of Enbridge.

The Motley Fool owns shares of and recommends Enbridge. The Motley Fool has a disclosure policy.

High Dividend Stocks List : Stocks That Pay Dividends | InvestorPlace

Chuck Saletta has been a regular Fool contributor since His investing style has been inspired by Benjamin Graham's Value Investing strategy. Chuck also can be found on the "Inside Value" discussion boards as a Home Fool.

Skip to main content The Motley Fool Fool. Premium Advice Help Fool Answers Contact Us Login.

Latest Stock Picks Stocks Premium Services. Stock Advisor Flagship service.

Rule Breakers High-growth stocks. Income Investor Dividend stocks. Hidden Gems Small-cap stocks.

Inside Value Undervalued stocks. Learn How to Invest.

Better To Invest In Growth Stocks Over Dividend Stocks For Younger Investors | Financial Samurai

Credit Cards Best Credit Cards of Best Credit Card Sign-Up Bonuses Best Balance-Transfer Credit Cards Best Travel Credit Cards Best Cash-Back Credit Cards Best No-Annual-Fee Credit Cards Best Small Business Credit Cards. Mortgages Compare Mortgage Rates Get Pre-Approved How Much House Can I Afford? Taxes How to Reduce Your Taxes Deductions Even Pros Overlook Audit-Proof Your Tax Return What Info Should I Keep?

Helping the World Invest — Better. How to Invest Learn How to Invest. Personal Finance Credit Cards Best Credit Cards of Best Credit Card Sign-Up Bonuses Best Balance-Transfer Credit Cards Best Travel Credit Cards Best Cash-Back Credit Cards Best No-Annual-Fee Credit Cards Best Small Business Credit Cards.

Apr 10, at 9: Service Corporation International NYSE: Prev 1 2 3 4 Next. Motley Fool push notifications are finally here Allow push notifications to help you stay on top of Breaking investing news Earnings coverage Market movers Special offers and more Subscribe to notifications You can unsubscribe at any time.