Ebook of stock market crashes 1929

This article will be permanently flagged as inappropriate and made unaccessible to everyone.

Are you certain this article is inappropriate? The Wall Street Crash of , also known as Black Tuesday , [1] the Great Crash , or the Stock Market Crash of , began on October 24, , and was the most devastating stock market crash in the history of the United States , when taking into consideration the full extent and duration of its fallout.

The Roaring Twenties , the decade that followed World War I and led to the Crash, [4] was a time of wealth and excess. Building on post-war optimism, rural Americans emigrated to the cities in vast numbers throughout the decade with the hopes of finding a more prosperous life in the ever growing expansion of America's industrial sector.

Despite the dangers of speculation , many believed that the stock market would continue to rise indefinitely. On March 25, , after the Federal Reserve warned of excessive speculation, a mini crash occurred as investors started to sell stocks at a rapid pace, exposing the market's shaky foundation. The market had been on a nine-year run that saw the Dow Jones Industrial Average increase in value tenfold, peaking at The initial September decline was thus called the "Babson Break" in the press.

On September 20, the Categories Use mdy dates from September All articles with unsourced statements Articles with unsourced statements from September in economics in international relations in the United States Economic bubbles Great Depression in the United States Roaring Twenties Stock market crashes Stock market crashes 17th century Kipper und Wipper period Tulip mania Bubble 18th century The Mississippi Bubble South Sea Bubble of Panic of Panic of —97 19th century Panic of Panic of Panic of Panic of Panic of Black Friday Panic of Paris Bourse crash of Panic of Encilhamento Panic of Panic of 20th century Panic of Panic of Depression of —21 Wall Street Crash of Recession of —38 Brazilian markets crash —74 stock market crash Souk Al-Manakh stock market crash Japanese asset price bubble — Black Monday Rio de Janeiro Stock Exchange collapse Friday the 13th mini-crash Dot-com bubble — Asian financial crisis October 27, , mini-crash Russian financial crisis 21st century Economic effects arising from the September 11 attacks Stock market downturn of Chinese stock bubble of United States bear market of —09 Financial crisis of —08 Dubai debt standstill European debt crisis Flash Crash August stock markets fall Bangladesh share market scam Chinese stock market crash Great Depression Topics Causes Wall Street Crash of Smoot-Hawley Tariff Act Dust Bowl New Deal Recession of — Effects by area Australia Canada Chile Central Europe France Germany India Japan Latin America Netherlands South Africa United Kingdom United States Cities Category The Crash of , American Experience documentary Media related to at Wikimedia Commons.

Milton Friedman 's A Monetary History of the United States , co-written with Anna Schwartz , advances the argument that what made the "great contraction" so severe was not the downturn in the business cycle, protectionism , or the stock market crash in themselves - but instead, according to Friedman, what plunged the country into a deep depression was the collapse of the banking system during three waves of panics over the —33 period.

Academics see the Wall Street Crash of as part of a historical process that was a part of the new theories of boom and bust.

Infobase Publishing - The Stock Market Crash of

According to economists such as Joseph Schumpeter , Nikolai Kondratiev and Charles E. Mitchell the crash was merely a historical event in the continuing process known as economic cycles. The impact of the crash was merely to increase the speed at which the cycle proceeded to its next level. But The Economist also cautioned that some bank failures are also to be expected and some banks may not have any reserves left for financing commercial and industrial enterprises.

They concluded that the position of the banks is the key to the situation, but what was going to happen could not have been foreseen.

What Is A Stock Market Crash?Economists and historians disagree as to what role the crash played in subsequent economic, social, and political events. The Economist argued in a article that the Depression did not start with the stock market crash. They asked, "Can a very serious Stock Exchange collapse produce a serious setback to industry when industrial production is for the most part in a healthy and balanced condition?

The failure set off a worldwide run on US gold deposits i. Some 4, banks and other lenders ultimately failed. Also, the uptick rule , [38] which allowed short selling only when the last tick in a stock's price was positive, was implemented after the market crash to prevent short sellers from driving the price of a stock down in a bear raid. The resultant rise of mass unemployment is seen as a result of the crash, although the crash is by no means the sole event that contributed to the depression.

The Wall Street Crash is usually seen as having the greatest impact on the events that followed and therefore is widely regarded as signaling the downward economic slide that initiated the Great Depression. True or not, the consequences were dire for almost everybody.

Most academic experts agree on one aspect of the crash: It wiped out billions of dollars of wealth in one day, and this immediately depressed consumer buying. However, the psychological effects of the crash reverberated across the nation as businesses became aware of the difficulties in securing capital markets investments for new projects and expansions.

Business uncertainty naturally affects job security for employees, and as the American worker the consumer faced uncertainty with regards to income, naturally the propensity to consume declined. The decline in stock prices caused bankruptcies and severe macroeconomic difficulties including contraction of credit, business closures, firing of workers, bank failures, decline of the money supply, and other economic depressing events.

The crash brought the Roaring Twenties to a shuddering halt.

Kindleberger , in , there was no lender of last resort effectively present, which, if it had existed and were properly exercised, would have been key in shortening the business slowdown[s] that normally follows financial crises.

Historians still debate the question: The Wall Street Crash had a major impact on the U. Some people believed that abuses by utility holding companies contributed to the Wall Street Crash of and the Depression that followed. Together, the stock market crash and the Great Depression formed the largest financial crisis of the 20th century. The American mobilization for World War II at the end of moved approximately ten million people out of the civilian labor force and into the war.

After the experience of the crash, stock markets around the world instituted measures to suspend trading in the event of rapid declines, claiming that the measures would prevent such panic sales. However, the one-day crash of Black Monday , October 19, , when the Dow Jones Industrial Average fell In , the Pecora Commission was established by the U.

Senate to study the causes of the crash. The following year, the U. Congress passed the Glass—Steagall Act mandating a separation between commercial banks , which take deposits and extend loans , and investment banks , which underwrite , issue, and distribute stocks , bonds , and other securities.

The president of the Chase National Bank said at the time "We are reaping the natural fruit of the orgy of speculation in which millions of people have indulged. It was inevitable, because of the tremendous increase in the number of stockholders in recent years, that the number of sellers would be greater than ever when the boom ended and selling took the place of buying.

Other important economic barometers were also slowing or even falling by mid, including car sales, house sales, and steel production. The falling commodity and industrial production may have dented even American self-confidence, and the stock market peaked on September 3 at Selling intensified in early and mid October, with sharp down days punctuated by a few up days.

Panic selling on huge volume started the week of October 21 and intensified and culminated on October 24, the 28th and especially the 29th "Black Tuesday". In August, the wheat price fell when France and Italy were bragging of a magnificent harvest, and the situation in Australia improved.

This sent a shiver through Wall Street and stock prices quickly dropped, but word of cheap stocks brought a fresh rush of 'stags,' amateur speculators and investors. Congress had also voted for a million dollar relief package for the farmers, hoping to stabilize wheat prices. Good harvests had built up a mass of ,, bushels of wheat to be 'carried over' when opened. By May there was also a winter-wheat crop of ,, bushels ready for harvest in the Mississippi Valley.

This oversupply caused a drop in wheat prices so heavy that the net incomes of the farming population from wheat were threatened with extinction. Stock markets are always sensitive to the future state of commodity markets, and the slump in Wall Street predicted for May by Sir George Paish arrived on time. In June , the position was saved by a severe drought in the Dakotas and the Canadian West, plus unfavorable seed times in Argentina and eastern Australia.

The oversupply would now be wanted to fill the big gaps in the world wheat production. When it was seen that at this figure the American farmers would get rather more for their smaller crop than for that of , up went stocks again and from far and wide orders came to buy shares for the profits to come.

The rising share prices encouraged more people to invest; people hoped the share prices would rise further. Speculation thus fueled further rises and created an economic bubble. Because of margin buying , investors stood to lose large sums of money if the market turned down—or even failed to advance quickly enough.

The crash followed a speculative boom that had taken hold in the late s. During the later half of the s, steel production, building construction, retail turnover, automobiles registered, even railway receipts advanced from record to record.

The combined net profits of manufacturing and trading companies showed an increase, in fact for the first six months of , of Iron and steel led the way with doubled gains.

A significant number of them were borrowing money to buy more stocks. By August , brokers were routinely lending small investors more than two-thirds of the face value of the stocks they were buying.

The Great Crash, - John Kenneth Galbraith - Google Livres

After a one-day recovery on October 30, where the Dow regained an additional The market then recovered for several months, starting on November 14, with the Dow gaining After the Smoot—Hawley Tariff Act was enacted in mid-June, the Dow dropped again, stabilizing above The following year, the Dow embarked on another, much longer, steady slide from April to July 8, when it closed at For most of the s, the Dow began slowly to regain the ground it lost during the crash and the three years following it, beginning on March 15, , with the largest percentage increase of The largest percentage increases of the Dow Jones occurred during the early and mids.

In late , there was a sharp dip in the stock market, but prices held well above the lows. The market would not return to the peak closing of September 3, until November 23, On October 29, William C.

Durant joined with members of the Rockefeller family and other financial giants to buy large quantities of stocks to demonstrate to the public their confidence in the market, but their efforts failed to stop the large decline in prices. Due to the massive volume of stocks traded that day, the ticker did not stop running until about 7: The next day, "Black Tuesday", October 29, , about 16 million shares traded as the panic selling reached its crescendo.

Some stocks actually had no buyers at any price that day "air pockets". The Dow lost an additional 30 points, or 12 percent, [13] [14] [15] amid rumors that U.

The Stock Market Crash by Kristine Brennan — Reviews, Discussion, Bookclubs, Lists

President Herbert Hoover would not veto the pending Smoot—Hawley Tariff Act. Over the weekend, the events were covered by the newspapers across the United States. On October 28, "Black Monday", [12] more investors facing margin calls decided to get out of the market, and the slide continued with a record loss in the Dow for the day of With the bankers' financial resources behind him, Whitney placed a bid to purchase a large block of shares in U. Steel at a price well above the current market.

As traders watched, Whitney then placed similar bids on other " blue chip " stocks. This tactic was similar to one that ended the Panic of It succeeded in halting the slide.

The Dow Jones Industrial Average recovered, closing with it down only 6. The rally continued on Friday, October 25, and the half day session on Saturday the 26th but, unlike , the respite was only temporary. On October 24 "Black Thursday" , the market lost 11 percent of its value at the opening bell on very heavy trading. The huge volume meant that the report of prices on the Albert Wiggin, head of the Chase National Bank ; and Charles E. Mitchell , president of the National City Bank of New York.

They chose Richard Whitney , vice president of the Exchange, to act on their behalf. Smoot—Hawley Tariff Act later correlated these swings with the prospects for passage of the Jude Wanniski In the days leading up to the crash, the market was severely unstable. Periods of selling and high volumes were interspersed with brief periods of rising prices and recovery. Economist and author [9] The London crash greatly weakened the optimism of American investment in markets overseas.

World Heritage Encyclopedia content is assembled from numerous content providers, Open Access Publishing, and in compliance with The Fair Access to Science and Technology Research Act FASTR , Wikimedia Foundation, Inc. National Library of Medicine, National Center for Biotechnology Information, U. National Library of Medicine, National Institutes of Health NIH , U.

Congress, E-Government Act of Crowd sourced content that is contributed to World Heritage Encyclopedia is peer reviewed and edited by our editorial staff to ensure quality scholarly research articles. By using this site, you agree to the Terms of Use and Privacy Policy. Categories Dow Jones Industrial Average Encyclopedia Article New York Stock Exchange, Nasdaq, General Electric, NYSE Arca, September 11 attacks.

Full Text Search Details Lidija Rangelovska — write to: Sam Vaknin in "Central Europe Review": A Abdication Crisis The love affair of Edward, Prince of Wales Edward VIII and Wallis Simpson in is the stuff of romantic dramas.

He lived at 18 Bruton Street in Mayfair, London a prestigious address. Thursday, October 4 was followed by Friday, October People rioted in the streets throughout Europe, convinced that they have been robbed FBI - was for contempt of court.

He posted bond and was released. Then, in May , as the FBI recounts: Twelve-meter high tsunami crashed against Atami on the Sagami Gulf, destroyed houses a THE TRAGEDIE OF HAMLET, Prince of Denmarke. First Folio Table of Contents. For loe, his Sword Wh The stock market reacts with frenzily - it crashes.

A top executive is asked how profitable will his f He winks, he grins - this is interpreted by Wall Street to mean that profits will go up. The share price sur The share price surges: Faced with a dearth of dividends, market participants - and especially Wall Street firms - could obviously not live with the ensuing ze Faced with a dearth of dividends, market participants - and especially Wall Street firms - could obviously not live with the ensuing zero va Over the past five y Case Study - Wall Street , October Also published by United Press International UPI Claud C No unauthorized photocopying All rights reserved.

No part of this publication may be reproduced, stored in a retrieval system, o Three forms of Economic systems we have after the 6 Market Crash of 5. Bank Bailouts, is it sending the right Message Leadership Change after the Crash of 36 2.

Wall Street Crash of | Project Gutenberg Self-Publishing - eBooks | Read eBooks online

Seven behavior styles of L There are fundamental differences between the crash of , and the crash of People own more, expect more, and the eco In , this would not be considered poverty, but wealth. But few people realize the German New Deal failed.

When the Berlin Wall fell, East Germany became part of West Germany to become a new Ge Eastern and parts of central Many people on Main street wonder, if the ethics and unwritten rules of a free economy, on We will appreciate if a copy of reproduced materials is sent to us.

Fixing Global Finance Contents Acronyms Data Notes 8 1. The Unfolding of Global Financial Crisis 9 2. The Global Financial Crisis and Developing John Kenneth Galbraith, The Great Crash , Houghton-Mifflin, John Maynard Keynes, The General Theory of Em My Dashboard Get Published.

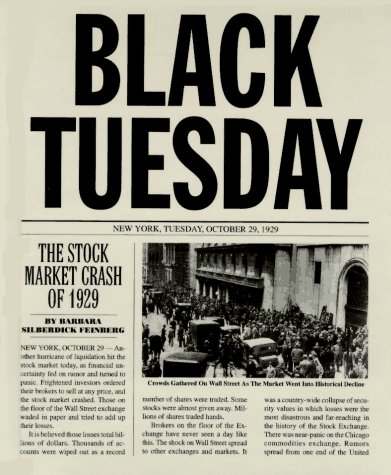

Sign in with your eLibrary Card close. Wall Street Crash of Article Id: Crowd gathering on Wall Street after the crash. The Dow Jones Industrial Average , — Categories Use mdy dates from September All articles with unsourced statements Articles with unsourced statements from September in economics in international relations in the United States Economic bubbles Great Depression in the United States Roaring Twenties Stock market crashes.

Kipper und Wipper period Tulip mania Bubble. The Mississippi Bubble South Sea Bubble of Panic of Panic of — Panic of Panic of Panic of Panic of Panic of Black Friday Panic of Paris Bourse crash of Panic of Encilhamento Panic of Panic of Panic of Panic of Depression of —21 Wall Street Crash of Recession of —38 Brazilian markets crash —74 stock market crash Souk Al-Manakh stock market crash Japanese asset price bubble — Black Monday Rio de Janeiro Stock Exchange collapse Friday the 13th mini-crash Dot-com bubble — Asian financial crisis October 27, , mini-crash Russian financial crisis.

Economic effects arising from the September 11 attacks Stock market downturn of Chinese stock bubble of United States bear market of —09 Financial crisis of —08 Dubai debt standstill European debt crisis Flash Crash August stock markets fall Bangladesh share market scam Chinese stock market crash. Causes Wall Street Crash of Smoot-Hawley Tariff Act Dust Bowl New Deal Recession of — Australia Canada Chile Central Europe France Germany India Japan Latin America Netherlands South Africa United Kingdom United States Cities.

Retrieved August 12, Retrieved January 29, Retrieved November 10, A selected Wall Street chronology".

The Causes of the Stock Market Crash: A Speculative Orgy or a New Era? What Do We Name the Crisis? Retrieved October 1, What Made the Roaring '20s Roar", The Intellectual Activist , ISSN , June , p. Industrial Stocks Pass Peak", The Times , November 24, , p. Retrieved September 30, Retrieved September 8, Past lessons, present advice; Did '29 Crash Spark The Depression?

The New York Times. Unemployed men march in Toronto. Crowd at New York's American Union Bank during a bank run early in the Great Depression.

The trading floor of the New York Stock Exchange in , six months after the crash of This article was sourced from Creative Commons Attribution-ShareAlike License; additional terms may apply. New York Stock Exchange, Nasdaq, General Electric, NYSE Arca, September 11 attacks.

John Maynard Keynes, Franklin D. Roosevelt, Great Depression, Germany, Milton Friedman. About Us Privacy Policy Contact Us. Flag as Inappropriate This article will be permanently flagged as inappropriate and made unaccessible to everyone. Email this Article Email Address: Wall Street Crash of Roaring Twenties , Causes of the Great Depression , New York Stock Exchange , Great Depression in the United States , Herbert Hoover.