Wellington fund vs total stock market

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires.

No matter where you fit in you'll find that Early-Retirement. Best of all it's totally FREE! You are currently viewing our boards as a guest so you have limited access to our community.

Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads , upload photographs, create a retirement blog, send private messages and so much, much more! I'd be curious to hear thoughts from both the many, I believe here who own this legendary fund as well as those who don't.

Harry Browne's Permanent Portfolio seemed to fit the bill and I certainly did well with it for a number of years, but Bill Bernstein and others finally convinced me that the effects of the "paper gold" market and other factors made the PP a dubious choice going forward.

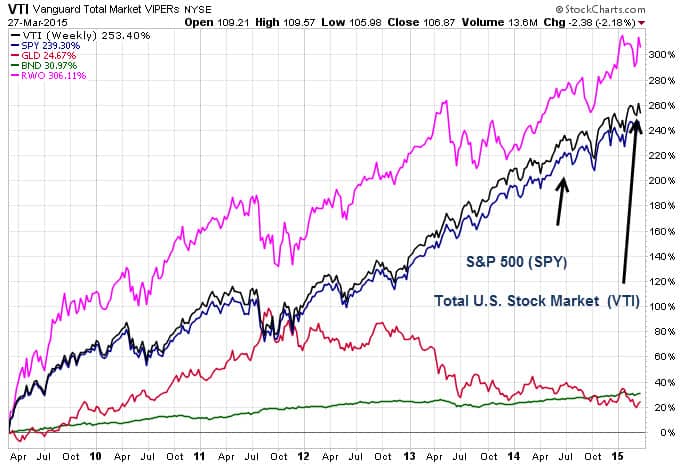

I've found myself coming full circle to giving up chasing alpha and pretty much just doing the Bogleheads 3 fund portfolio with total stock, bond and unfortunately? I appreciate the collective wisdom here and look forward to hearing some thoughts while apologizing for what has turned into an over-long rant! Join the 1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

I do not own Wellesley. My main holdings are IVV, IVW and DVY.

Vanguard Wellington: Is it a Good Fund? — Oblivious Investor

A few other small scatterings of mostly QQQ, IWM, FHLC, GLD. My rentals are my income source and 'bond allocation' My criteria for a stock these days is, no stocks. It must be a self balancing ETF. As companies get added and removed, I do not want a tax hit. I do not want a stock to give me capital gains unless I want it, think inversion and Medtronic.

I do not want to own the largest, most profitable company in the world, and see them go broke. Think PanAm, Arch Coal, Sun Microsystems, etc. All were great at one time, and went basically broke. As I buy monthly, I need to avoid the trading fees. The same when I sell. I want to set it and forget it. If I re-balance in an after tax account, I do not want to get hit with capital gains.

It's not so bad if I need the sale anyway, but I may be forced to take a gain I do not want quite yet. I also want low fees. An ETF generally has lower fees than a mutual fund. I do not want a high flyer. What goes up, will eventually come down.

I want to sleep well, knowing if I go broke, so does every one else. I don't have Wellesley. I called Vanguard a few years ago, wanting to buy Wellesley and Wellington. The agent talked me out of these and into the 3 fund portfolio. Vanguard Total Stock Market Index Fund VTSMX , Vanguard Total International Stock Index Fund VGTSX , Vanguard Total Bond Market Fund VBMFX.

Agent said that the 3 fund was more cost effective- less fees than Wellesley and Wellington. I haven't verified this. Sent from my iPad using Early Retirement Forum. Originally Posted by Senator. I do not want to get hit with capital gains. I do own Wellesley, but only inside my IRA. Originally Posted by kevink. I have been very happy with the fund's performance in the 11 years I've owned it. The fund's track record is impressive - only six down years out of the last 45, a performance I know I could never come anywhere close to achieving on my own.

Yes, past performance is no guarantee it will continue, but the same holds true of any investment strategy. Like travelover, I've told DW when I'm gone to move it all to Wellesley and live off SS and RMDs, which should provide her with a comfortable income. DH's IRA is in Wellesley. He's 67 and risk averse, so it seemed like a good fit for him. I am in the Vanguard fund. Over the past 5 years, his portfolio has crushed mine.

I expect that mine will crush his when there's a big runup in stocks.

Originally Posted by Ronstar. I guess Wellesley is my one nod to the value, if any, of active management and long-term performance. Pretty darn cheap compared to the industry as a whole.

Yes, I like the concept of a one-fund set it and forget it solution but doubt I'll ever quite get there. My wife and I own VWIAX Wellesley Admiral and VWENX Wellington Admiral as primary holdings in our IRA accounts. We decided to move from an aggressive portfolio last year, and sought a lower volatility allocation to take us through the first 5 years in retirement.

The old man in the cave told me to move to muni bonds, but they do not fit an IRA. We are up YTD 6.

We do have a small allocation of HY corp individual derivative style bond, which is fairly high risk I am told. I recently have been testing Paul Merrimans Ultimate Retirement Portfolio. His research and statistical allocation are "sound advice", and free for the reading.

Wellesley is not a "diversified" portfolio in itself. I have heard that Vanguard would not recommend holding Wellesley or Wellington as the whole portfolio.

Don't get me wrong, I like both funds. There just are other holdings needed to diversify properly. I use mostly ETFs, some broad indexes and some more focused indexes. Originally Posted by bingybear. My logic may sound goofy but I considered Wellesley to be my first bucket with 5 years of living expenses since it fairs very well even during the worst of times, Wellington as my second bucket and VGHAX as my third bucket.

Originally Posted by Happyras. VG offers a free FA for Flagship, I have a meeting with one next week to get a full flavor of the current VG allocation plan. As for ETF's, not a fan from being burnt so badly on market spread. My former accountant started the Madrona Fund ETF's, put all of accounts in his own ETF's, charged his normal 0. Other holdings diversified between indexes, active funds, individual stocks and cash. Of course I'm referring to workouts, not robbing banks.

John C. Bogle on the S&P vs. the Total Stock Market - CBS News

It has performed beautifully since I first purchased it in with great defensive action in severe down markets. The downside to this is that when everybody is bragging about their great investment prowess as in for example one just smiles and thinks -" you just wait I do not own it because with a little patience 10 years initial investment into something like VTI will have higher yield on my money taxed at lower rate.

If I would own it would be in my IRA since it is not tax efficient. Thread Tools Show Printable Version. Display Modes Linear Mode Switch to Hybrid Mode Switch to Threaded Mode. Search this Thread Advanced Search. BB code is On.

Pension in your asset allocation. Emerging market debt - signs of a Preferred Stock Investing-The Good , Hey man, got any Bitcoin? Contact Us - Portal Page - FIRECalc - Sitemap - Community Rules - Terms of Service - Privacy - Top. Do not remove this copyright notice. Do not remove or your scheduled tasks will cease to function Do not remove or your scheduled tasks will cease to function. Useful Links Home Page Forum Listings Edit Account Options Edit My Profile Meet Our Team Register it's FREE!

This early retirement and financial independence community is a member of the Social Knowledge network, a group of high quality forum communities. This community was started in as an alternative to a then fee only Motley Fool.

The focus of the discussions is on topics related to early retirement and financial independence. The community is moderated to ensure a pleasant experience for our members.

Register FAQ a Calendar Today's Posts. All times are GMT The time now is Click Here to Login. Page 1 of 5. Somewhere between Chicago and Phoenix Posts: MBSC Full time employment: Originally Posted by Senator I do not own Wellesley. Picasso Give me a forum Originally Posted by kevink I've found myself coming full circle to giving up chasing alpha and pretty much just doing the Bogleheads 3 fund portfolio with total stock, bond and unfortunately? REWahoo Give me a museum and I'll fill it. Texas Hill Country Posts: Originally Posted by Ronstar I don't have Wellesley.

Originally Posted by bingybear Wellesley is not a "diversified" portfolio in itself. Originally Posted by Happyras VG offers a free FA for Flagship, I have a meeting with one next week to get a full flavor of the current VG allocation plan.

Lsbcal Give me a museum and I'll fill it. Originally Posted by kevink Eee Bah Gum Posts: Currently Active Users Viewing This Thread: Switch to Hybrid Mode. Switch to Threaded Mode. You may not post new threads You may not post replies You may not post attachments You may not edit your posts BB code is On Smilies are On [IMG] code is On HTML code is Off Trackbacks are Off Pingbacks are Off Refbacks are Off Forum Rules.

How to get a Swiss Army Knife on a plane when everything else can go in the overhead? Register Portal Forums Post Feed New Posts Subscribed Photos FIRE Links Our Team FAQs FIRE Calc Vanguard Schwab Scott Burns Insurance Go RVing Campground Go Sailing Cooking Airstreams Google.

Social Knowledge Community This early retirement and financial independence community is a member of the Social Knowledge network, a group of high quality forum communities. About Us This community was started in as an alternative to a then fee only Motley Fool.