Stock market during recession

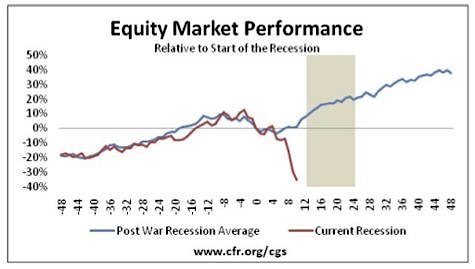

A Wealth of Common Sense. Posted March 15, by Ben Carlson. I shared the following table with each recession since the lates:. The next logical step from here is the see how stocks performed in and around these past recessions. This is another piece of evidence that shows why investing during periods of unrest usually pays off for investors.

Three years out from a recession the annual returns showed an average annual gain of Five years out the average annual gain was Only one time since was the stock market down a year later following a recession, which occurred during the bear market.

During the actual recessions themselves the total returns look much worse as they were negative, on average. But this average is made up of a wide range in results, as stocks have actually risen during 4 out of the last 9 recessions. And stocks were positive 6 out of the past 9 times in the year leading up to the start of a recession, dispelling the myth that the stock market always acts as a leading indicator of economic activity.

All of which is to say, what these numbers really tell us is that, in general, stocks tend to perform below average in the year leading up to and during a recession and perform above average in the 1, 3, and 5 years following the end of a recession with the usual caveats that there are always outliers and this is a small sample size. Brett Arends of MarketWatch who himself was trying to figure out if we were already in a recession in late showed why it can be so difficult to predict recessions in real-time:.

Remember the Great Recession that began in December, ? By amazing coincidence, that was actually the month it ended as they told us many months later. And so it goes.

Investor expectations are fickle. Every market and business cycle is unique, as anyone who has been trying to handicap the current rally can attest to. Here are those results along with the averages over the entire period: Are we already in a recession? When Will the U. Have Its Next Recession? Inflation is a Relatively New Phenomenon.

I was pretty sure about this, but now am very sure.

As you know, with my Cash Reserve Method — what you named The Four Year Rule when you posted it last August 17 — calls for continuing to draw down the cash reserve for two years after a bear market ends and then to ratably selli shares to replenish the reserve over the following two years in order to take advantage of the significantly higher market prices that are likely to be in effect during those years.

Your data plus my personal experience since supports my thinking regarding this. Thanks for the research. When the NBER announces a recession, they use a wide variety of data, including privately published data, to pin down the exact month it began.

Frustrated with this state of affairs, I constructed my own recession model using several leading indicators.

Stock market crash - Wikipedia

It identifies the beginning of recessions with little lag. Usually a stock market low occurs before the recession is over.

I think people were hopeful that the people at ECRI had things figured out but their call in of a recession was obviously way off. Keep me posted on your model.

A Wealth of Common Sense is a blog that focuses on wealth management, investments, financial markets and investor psychology.

Is the stock market overvalued by 50 percent? PE ratios out of sync with fundamentals underlying the economy. Not in labor force group in US increased by 15 percent since recession ended.

I manage portfolios for institutions and individuals at Ritholtz Wealth Management. More about me here. Great news, we've signed you up. Sorry, we weren't able to sign you up. Please check your details, and try again. Every month you'll receive book suggestions--chosen by hand from more than 1, books. You'll also receive an extensive curriculum books, articles, papers, videos in PDF form right away. A Wealth of Common Sense Home About Invest with Ben My Books Contact.

Recession: What Does It Mean To Investors?

Now go talk about it. Discussions found on the web. John Thees commented on Mar 16 Great article, Ben. What We're Reading This Morning — March 16, commented on Mar 16 […] Stock Performance Before, During, and After Recessions — A Wealth of Common Sense […]. Jim Haygood commented on Mar 17 When the NBER announces a recession, they use a wide variety of data, including privately published data, to pin down the exact month it began.

Ben commented on Mar 17 I think people were hopeful that the people at ECRI had things figured out but their call in of a recession was obviously way off. Dcoronata commented on Mar 18 Very hard to accurately predict the start date when the data they have is often weeks old. Best of the Web: Debunking dividend myths Since Simon Cunningham commented on Mar 22 Really powerful data. Thanks for putting it together. Keep it simple Best of the Web commented on Mar 25 […] http: Stock Market Sell-Offs Without a Recession - A Wealth of Common SenseA Wealth of Common Sense commented on Jan 17 […] Further Reading: More from my site The Expectation of Losses Where Has All The Volatility Gone?

Get Some Common Sense Sign up for my newsletter Email: Get a Full Investor Curriculum: Join The Book List Every month you'll receive book suggestions--chosen by hand from more than 1, books. Get Some Common Sense Sign up for my newsletter.