Trec earnest money contract texas

You are using an outdated browser. Please upgrade your browser or activate Google Chrome Frame to improve your experience. If the seller agreed to deliver the existing survey to the buyer, he is required to deliver the survey and the affidavit within the specified time. Paragraph 6C 1 says, in bold, "If Seller fails to furnish the existing survey or affidavit within the time prescribed, Buyer shall obtain a new survey at Seller's expense no later than 3 days prior to Closing Date.

The seller could try to obtain another copy from the surveyor or title company he used when purchasing the property so that he can fulfill his contractual obligations. To avoid this situation, sellers should only agree to provide an existing survey if they have it readily available.

The listing agreement you choose depends on how the buyer will likely use the property. If a buyer will probably use the lot for residential purposes, like building a home, the Residential Real Estate Listing Agreement, Exclusive Right to Sell TAR would be the best choice. A seller has no legal duty to respond to an offer in any particular way. A verbal counteroffer could expedite negotiations for the sale of a property in many cases.

Of course, once there is an agreement about the terms and conditions of the sale, the parties should promptly reduce the agreement to writing and sign the contract to make it a binding obligation. A seller could respond to a buyer's offer by using the Seller's Invitation to Buyer to Submit New Offer TAR This form would be particularly useful when the seller's proposal contains several changes to the buyer's offer.

By using this form, the seller is free to consider other offers without having to be concerned about the withdrawal of a previous, written counteroffer. Earnest money is not necessary to make an otherwise accepted offer into a valid contract. Earnest money is a buyer-performance item required to be deposited after a contract is fully executed. A contract could become effective even if no earnest money is required in the agreement.

If the principal does not want to sign the form, the agent could note the delivery of the form in his or her file. Can the parties enter into an effective temporary lease without a daily rental amount in Paragraph 4?

Parties can negotiate a contract where no additional rental fee for the term of the temporary lease is required. The other terms of this agreement to sell the property, which includes the temporary lease as part of the main contract, could provide sufficient consideration for the lease to be effective and enforceable without specifying additional monetary consideration for the temporary-lease term.

A verbal agreement must be reduced to writing and signed by the buyer and seller to become valid. Since a contract was never created, nor signed, there is nothing for the buyer to enforce. While verbal negotiations of contracts can be a quicker way to reach an agreement, verbal agreements are not enforceable for the sale of real property. The Farm and Ranch sales contract is still the most appropriate in this instance.

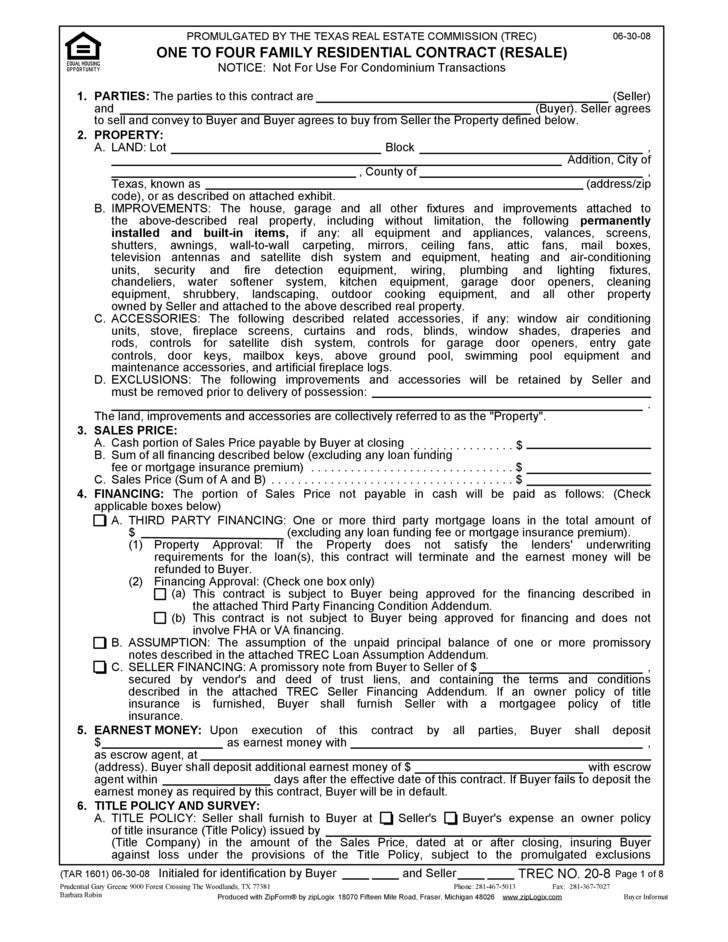

Texas Residential Sales Contracts

Though both the Farm and Ranch sales contract and the One to Four Family Residential Contract Resale sales contract require the TREC Addendum for Reservation of Oil, Gas and Other Minerals if a seller wants to reserve a mineral interest, a number of other differences remain between the two contracts.

Examples of some items addressed on the Farm and Ranch form but not on the One to Four Family Residential Contract Resale form include: Additionally, acreage over one acre will weigh in favor of using the Farm and Ranch sales contract.

The Third Party Financing Addendum is designed to limit the maximum amount of interest and loan fees that a buyer would be obligated to pay as part of his loan contingency. Inserting the word market in lieu of a stated interest rate or leaving a blank space for the maximum loan fees would defeat the purpose of the loan contingency.

The market interest rate might be several percentage points higher than the buyer intended, assuming it was possible to to determine what the market rate was at a particular time in the contracting process.

Similarly, a buyer might be required to pay a much greater amount of loan fees than he intended if that figure was left blank and a court imposed a "reasonable" or "market" test to determine the amount of permitted loan fees. TREC and the Broker Lawyer Committee intended that percentage figures would be inserted in these two blanks or they would not have promulgated the form with percentage signs after the blanks.

Clarity in contracts requires that buyers research what the current market allows for interest rates and loan fees, which are defined in paragraph 12A 2 a of the TREC contracts, and that those percentage figures are inserted in the appropriate blanks. Ambiguity or unenforceability of contracts can be avoided by careful attention to inserting appropriate percentage figures in these blanks. Seller's disclosure requirements do not apply to foreclosure sales, or to the subsequent sale by a foreclosing lender Texas Property Code Section 5.

Foreclosure sales are also exempt from the federal lead-based-paint disclosure requirements. However, a subsequent sale by the purchaser at a foreclosure sale, including a foreclosing lender that purchased the property at the foreclosure sale, is not exempt from the lead-based-paint disclosure requirements for pre property. Lenders or any other buyers who purchase such property should complete and attach the TREC lead-based-paint addendum TAR to the sales contract and provide the federally approved pamphlet to the buyer.

The deposit of earnest money is a buyer obligation once the contract is effective. Since the contract does not include an automatic extension to allow the lender time to complete his role, your seller has two options. He could amend the contract to extend the closing date to allow the lender time to process the loan.

Another option is to consider the buyer in default. However, since time is not of the essence to the closing date, the buyer might argue that a short delay in closing is not a material breach of contract. This issue may end up in court. Disclosure of representation, including intermediary status, is made in the box captioned "Broker Information and Ratification of Fee" on the last page of each form. Under the Third Party Financing Addendum, the buyer has a certain number of days within which to give the seller written notice that the buyer cannot obtain financing approval.

Financing approval in this case means that the terms of the loan described in the addendum are available and that the buyer has satisfied all of the lender's financial requirements relating to the buyer's assets, income, and credit history. If the buyer does not give the seller such a notice within that time period, the contract will no longer be subject to or contingent upon the buyer's financing approval for the described loan and the buyer's assets, income and credit history.

No such time limit restricts the lender's underwriting approval of the property under Paragraph B2 of the addendum. The lender's underwriting approval of the property can be dependent upon many factors e. This time distinction is important. Under the Third Party Financing Addendum, if the buyer gives the notice within the days stated then the contract terminates and the earnest money will be refunded to the buyer.

A failure by the buyer to give the timely notice means that a subsequent failure to obtain the financing approval for the type of loan described and the buyer's financial requirements would not allow for the automatic termination of the contract and refund of the earnest money to the buyer. Conversely, no matter when the lender determines that the property does not satisfy the lender's underwriting requirements for the loan, the contract terminates and the earnest money should be refunded to the buyer.

Under no circumstance should a real estate license holder attempt to prepare a lease-purchase agreement. Preparing your own document or changing a lease-purchase agreement prepared by an attorney for another transaction is a violation of the Real Estate License Act. Taking such action is the unauthorized practice of law. Property sold at foreclosure 3. Housing for elderly or disabled residents where no child under six years old is expected to reside. The process for creating agricultural development districts was enacted in by the Texas Legislature to promote the development of agricultural facilities that result in employment and economic activity.

However, to date, no such districts have been created, according to the Texas Department of Agriculture. The seller and buyer of property in an agricultural development district must also sign a notice at closing that is recorded in the deed records. Paragraph 7D 2 of the TREC contracts is the appropriate section to cover a seller's agreement to repair a specific item of the property. Paragraph 12A 1 b should be used to show the seller's contribution to the buyer's closing costs.

This paragraph already provides for language to limit the seller's obligation to the amount shown in the blank space. Note that the paragraph also controls the order in which the seller's contribution shall be applied to various buyer's expenses. Since the parties haven't agreed on the termination of the contract and no judge has decided the issue, you shouldn't give either party advice about the termination of the contract.

Tell your seller to get advice from his attorney concerning the risks of proceeding with a subsequent sale of the property without a final settlement of the issue of contract termination. The seller's primary goal should be to have formal termination of the contract.

That ensures he can put the property back on the market and sell it to someone else without risking a lawsuit that could stop a subsequent sale of the property. A contract can be formally terminated if both parties agree to terminate—usually in writing with a release-of-earnest-money form—or if a judge orders the contract to be terminated.

Because of the potential risk of an adverse ruling by a judge concerning the seller's right to terminate the contract, title companies often refuse to open a second escrow file on a property where the first contract has not been formally terminated. Remember that Texas Real Estate Commission contracts now require buyers and sellers to participate in mandatory mediation to resolve disputes before going to court. Paragraph 6 of the Farm and Ranch Contract TAR , TREC has specific language that deals with outstanding mineral interests that would be an exception to title in the owner's title policy and in any deed to the property.

The Farm and Ranch Contract also covers outstanding surface leases, and any farm and ranch improvements and accessories that might be involved in this sale. A buyer interested in purchasing the property even when mineral interests have already been conveyed to or reserved by another person can list the exception documents in the offer.

The seller can provide documents that contain or reserve those mineral interests to any prospective buyer to list in Paragraph 6. When listed, those interests would be acknowledged by the parties and not subject to objection by the buyer during title commitment review.

To ensure the buyer and the seller have a meeting of the minds about the nature of the title to the property and the outstanding mineral interests, the seller could provide the appropriate documents to the buyer and require the use of the Farm and Ranch Contract as a condition of accepting any offer by this buyer. The landlord must still comply with the notice requirements in Paragraph 4B of the TAR lease.

The parties to the contract should consider several factors before deciding what contact information should be inserted in Paragraph Time is of the essence in almost all of the notice provisions in TREC contracts. This means they require time-sensitive action. Having an agent as the point of contact to receive notices for his or her client could create delays that may result in the party losing a time-sensitive option or right provided in the contract, such as the Paragraph 23 termination option or the Third Party Financing Addendum for Credit Approval.

In this situation, you can use Amendment to Listing TAR A provision in the amendment states that the seller is instructing the broker to cease marketing the property until further notice or until a specific date. The provision states that the listing is not terminated and remains in full effect. If you determine that you wish to terminate the listing agreement, you can use Termination of Listing TAR This form provides for early termination of a listing and determines whether the broker will receive compensation for early termination.

The seller may believe that the mineral interests may generate some income or value to him. The determination of this value may be small or it may be significant. What is a reservation as it relates to mineral interests? For example, the seller may sell a property but may reserve to himself or others one-half of the mineral interest in the property. Under this example, one-half of the mineral interests are severed from the property, assuming that the seller owned all of the mineral interests before agreeing to sell.

Who should sign this form, and should it be attached as an addendum to the contract? This form is designed to provide general information about minerals and mineral clauses.

This form can be signed by whoever receives it in order to acknowledge receipt of the form. Since the form is informational in nature, it is not intended to be an agreement between a buyer and a seller and should not be attached to or made a part of any contract. If the parties wish to have mineral clauses made part of their contract, an oil and gas attorney should be retained to draft and include the appropriate clauses for the contract.

A seller received two offers at about the same time. He wants to counter both. May he do so? The seller could reject both offers and invite the prospects to submit better offers or the seller could make a counteroffer to one prospect.

When a party makes an offer or counteroffer, that party gives to the other party the power of acceptance to create a binding contract. Therefore, overnight delivery may be necessary to ensure that the buyer has an option period. It depends on how long the back-up buyer wants to stay in the back-up position. If your client wants his back-up contract to last until or beyond the first contract's closing date, you can also ask the listing agent to provide the first contract's closing date.

The buyer makes a written offer through his agent to the listing agent on May The listing agent delivers the offer to the seller on May The seller signs the offer as submitted on May 17 and delivers the signed offer to the listing agent on May The listing agent emails the executed contract to the buyer's agent on May The buyer's agent calls the buyer on May 20 and informs the buyer that the seller has accepted the offer.

The effective date in this example is May 19, the date the listing agent communicated to the buyer's agent that the seller signed and unequivocally accepted the buyer's offer. A listing broker should always act on the instructions of the seller that fall within the scope of the agency relationship between the seller and broker. A listing broker should not present offers to a lender unless the seller instructs the broker to do so.

If the seller instructs the listing broker to present offers to the lender, the listing broker has not breached the fiduciary duty that is owed to the seller; rather, the listing broker is following the instructions of the client. A seller authorized me to advertise in the MLS that her refrigerator conveys with the sale. The buyer says she should have left it since it was advertised as conveying with the sale in the MLS listing.

Does the seller have to give the buyer the refrigerator? If the signed contract does not state that the refrigerator conveys with the property, the seller does not have to leave it. This situation is an example of why agents should help clients ensure all material items of prior agreements are contained in the signed contract. Earnest money is not "consideration" for the TREC contracts. A real estate contract is an enforceable contract if it is in writing, shows a meeting of the minds on all terms and conditions, and is signed by all parties to the contract.

The promise of the seller to sell and of the buyer to buy is sufficient consideration to support the making of a contract. The failure of a party to perform an obligation required under the terms of the contract, including a failure of a buyer to timely deposit earnest money, is a default by that party authorizing the other party to exercise any of the default remedies described in paragraph 15 of the TREC contracts.

The formal notification by a seller in writing to a buyer would be prudent in order to eliminate an argument by the buyer that by conduct or comment the seller might be waiving his right to insist on timely performance by the buyer of his obligation to deposit the earnest money. What is an exception as it relates to mineral interests? For example, a seller of real property may sell the property with the exception that some other person already owns one-half of the mineral interests.

This other person is usually identified somewhere in the chain of title. My client has submitted an offer to purchase a home. We have not heard from the seller or his agent regarding the offer. My client has now found another home that he likes better and wants to withdraw the first offer. Since your client wants to withdraw his offer before the seller has accepted it, a prompt communication of that withdrawal is essential.

It should be noted that this same procedure could be used by a listing agent where the seller wants to withdraw a counteroffer made to a buyer so that he can sell the property to another buyer.

Even though a buyer or seller can propose an amendment to the contract at any time, merely proposing an amendment to a contract—or refusing to accept a proposed amendment—does not give either party a unilateral right to terminate an existing contract.

The contract is only changed after the parties sign the amendment signifying their agreement. Without a fully executed amendment, the original contract remains in effect as written. Keep in mind that if the buyer purchased a termination option that had not yet expired, the buyer could terminate the contract for any reason.

By signing the forms, the parties have instructed the broker to fill in the final date of acceptance as the effective date. If the broker failed to fill in the effective date, the broker may be placed in the precarious position of later having to determine the effective date of the contract.

The final date of acceptance is a fact issue that must be resolved either by the parties with the assistance of the brokers or, ultimately, a court of law.

The effective date is determined by the final date of acceptance. The final date of acceptance is the date on which the contract becomes binding between the parties. It is the date that both buyer and seller have agreed to all terms of the contract and have executed the contract. Four elements must be satisfied for final acceptance to take place:.

The final contract must be in writing. This is typically satisfied when negotiations are made using promulgated forms. The buyer and seller must sign the final contract, including the initialing of any handwritten changes to the initially drafted offer, if applicable. Acceptance must be unequivocal. The effective date is the date when the last element communicating acceptance back is made after the other three elements are satisfied.

One reason why communicating acceptance back to the other party is mandated is so the other party will know when the contract performance requirements or periods for performance begin.

Again, the seller may be subject to certain requirements of the lender about which a real estate licensee should be careful not to advise his client. Instead, this question should be directed by the seller to the seller's attorney. As a broker, I wrote a reservation clause in special provisions in a contract form either a TREC residential form or a TAR commercial form because my seller said he wanted to retain the minerals.

If a complaint is filed, will TREC initiate disciplinary action against me? The answer to the question depends on the specific facts that are determined by the investigation.

TREC will likely look at whether the issue at hand was a complex matter. Additionally, TREC will likely look at the specific wording in the clause to see if it properly reflected the intent of the parties. Did the drafting of the clause contribute to any of the problems for which the complaint was filed? Of course, the broker's defense will be that the clause was a "business detail" and did not constitute the unauthorized practice of law.

But this will be a fact issue. What is an executive right? Many times, it is severed when the mineral estate is sold to multiple parties. For example, if a person sells half of the mineral estate to another, the seller may decide to retain the power to lease the entire mineral estate at his discretion.

Under this example, the other mineral interest owners would not be able to participate in the decision to lease the minerals. The seller promised to have the utilities on next week, so my buyer just wants to extend the termination-option period another 10 days. Will the buyer have to pay another option fee even though the extension is because the seller breached the contract? If the buyer in this situation chooses to request an extension of the termination-option period instead of exercising the default remedies available to him in the contract, then he must agree to offer something of value as consideration to the seller to ensure that the extension is legally enforceable.

This is often done by paying an additional termination-option fee. Extensive case law in Texas suggests a termination-option period cannot be extended without an additional option fee, so a buyer should pay another option fee to reliably extend the option period. This form allows you to register your buyer to cover the purchase of the owner's property during an agreed time period.

It also contains language to provide that the owner will pay your negotiated fee should your buyer purchase the property. The agreement doesn't allow you to list the property for sale or require the owner to pay you a fee should the owner sell the property to someone else. It is not intended to take the place of a buyer's representation agreement between a broker and his buyer client.

The commercial contracts address the matter of the effective date in paragraph The task force of commercial practitioners working on these contracts felt that because of the way that many commercial contracts are negotiated it would be appropriate to provide that the time for performance of the parties should not begin until the escrow agent receipts the contract after all parties have signed.

This was done to allow for delays often experienced in commercial transactions in getting the contract to the escrow agent and to allow the parties to not have to begin performance obligations until the contract was escrowed. This means that for "the purpose of performance of all obligations" the clock does not start running for the parties until the contract has been receipted by the escrow agent. This does not mean that there is no enforceable contract prior to the receipt by the escrow agent.

To the contrary, the law of offers and acceptance would still control and there would be an "enforceable" contract under the statute of frauds when the last party to accept all of the terms of the contract signs the contract and communicates that acceptance and signing to the other party. Thus, while the date for the beginning of performance is handled in a different way in the commercial contracts than in the TREC contracts, the law regarding when there is an enforceable contract is the same for both.

It should also be noted that the Escrow Receipt at the end of the commercial contracts has a parenthetical reference that the day of the receipt of the contract is the "effective date. It might be a good idea for both brokers to confirm the effective date between themselves when communicating final acceptance.

This question depends on the relationship between the seller and the seller's lender. As a real estate licensee, you should be careful not to advise the seller on this relationship; encourage your seller to seek the advice of an attorney.

Leaving both boxes blank in Paragraph 7D or altering the contract terms by adding language in Paragraph 7D 2 that does not list specific repairs could be considered to be acting negligently or incompetently if a complaint were to be filed in connection with the transaction.

Otherwise, the buyer should check Paragraph 7D 1. Most buyers in this situation will also choose to pay a termination-option fee pursuant to Paragraph 23 in exchange for the right to terminate the contract for any reason within a negotiated number of days.

During this termination-option period, an inspection can be performed, and if specific repairs are identified, the parties can negotiate to amend the contract to address these items, or the buyer can terminate the contract. The committee believes that the better public policy is to provide for the conveyance of the fee simple estate without reservations in residential sales that utilize the standard TREC forms.

Due to the fact that most residential property owners in urban and suburban areas are not familiar with oil and gas transactions, the committee believes that the negotiation of such matters is best addressed by attorneys representing the parties in residential sales.

Additionally, historically, these items have not been at issue during negotiations in the typical residential sale probably due to the fact that the minerals may have been severed, the surface is too small to worry about drilling activity, and cities have regulated drilling activities within their jurisdictional limits. Based on the foregoing, the better alternative for the broker in this question is to suggest to the parties to seek the advice of counsel.

What is a bonus? There are other types of bonuses that may be negotiated. My client received a full-price offer on a property I listed for him after signing a Residential Real Estate Listing Agreement Exclusive Right to Sell TAR , but he now states he is no longer interested in selling his property and refuses to accept the offer. I believe that I still deserve my commission because I fulfilled my obligation under the listing agreement by bringing him a suitable buyer.

Am I still entitled to receive my commission? Paragraph 5 of the TAR Listing Agreement explains that a seller will pay the broker either a percentage of the sales price or a set fee when the compensation is earned and payable.

In this situation, you could argue that the compensation was earned when you procured a buyer who was ready, willing, and able to buy the property at the listing price, and the compensation was payable when the seller refused to sell the property after your compensation had been earned. If negotiations with your client fail and your client is not willing to pay your compensation, you may need to contact an attorney. The amount of the option fee is negotiable, but it would be wise to pick a number that does not appear to be simply a symbolic gesture.

On Saturday evening, the listing agent notifies the buyer's agent that the seller accepted the offer from the buyer. The seller accepted the offer unequivocally and signed the contract.

The buyer's agent informs the listing agent that he will not be able to notify the buyer of the acceptance until Monday. Should the brokers insert Monday as the effective date? Under these facts the elements of final acceptance are satisfied on Saturday.

How important is it for the effective date of the contract to be filled in? It is the date from which most, if not all, performance periods are measured. One of the most significant complaints that escrow agents make about real estate licensees is that, many times, licensees fail to insert the effective date in the contract. If a sales contract is executed by a buyer and seller with a sales price of less than what the seller owes and the sale is subject to the lender's approval, what should the MLS status be reflected as?

Generally speaking, the status should be "pending. The seller of a commercial property has rejected my client's offer to purchase that property.

We used TAR form , Commercial Contract—Improved Property. The seller's agent said the seller rejected the offer because he was selling the property "as is" and was not going to do any repairs. Therefore, the buyer's request for a feasibility period and his right to inspect the property were not necessary for the contract.

The listing agent suggests that we submit another offer without the feasibility paragraph checked on the form. Do we have to choose between the property condition "as is" paragraph and the feasibility paragraph in the contract?

Paragraph 7A of the TAR contract allows for the buyer to purchase the property "as is" or to require certain seller repairs as part of the contract provisions. Regardless which choice is made in paragraph 7A, there is nothing inconsistent with either of those choices and a buyer's right to inspect the property and possibly terminate the contract under the terms of paragraph 7B, the feasibility paragraph.

While a seller could refuse to permit a buyer to have inspections or a right to terminate under a feasibility period, it is generally not a good idea to try to prevent a buyer from having a right to freely inspect the property. Such a restriction might increase the seller's risk of a subsequent claim of withholding information about the condition of the property.

Furthermore, most buyers are going to be reluctant to buy a property without a right to inspect the property and often would not buy commercial property without a feasibility study and a companion right to terminate if not satisfied about the viability of the proposed project. You might discuss these points with the seller's agent and see if a thoughtful reconsideration of these matters by the seller might create an opening for you to resubmit your client's offer.

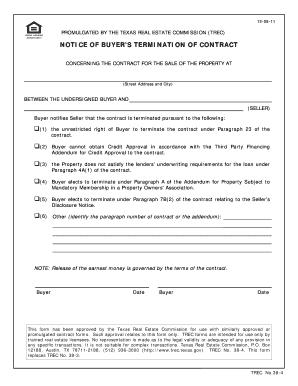

It should be stressed that the granting of the buyer's feasibility study period and his inspection rights do not obligate the seller to do any repairs. I discovered that the TREC notice form for a buyer to terminate the contract under the Third Party Financing Condition is no longer available on ZipForm. What form should I use?

This form was designed to combine the notices of two prior TREC forms and to add a reference to several other paragraphs or addenda where the buyer can notify the seller that the contract is terminated. This form was promulgated by TREC with a mandatory use date of Sept.

When a broker completes the TREC Farm and Ranch Contract form, what is the best way to draft a reservation clause in Paragraph 2F? The broker must exercise caution when completing Paragraph 2F because the reservation clause may become complex. The broker will need to determine the extent of the mineral interests and rights that the owner wishes to reserve. This may or may not become an issue of significant negotiations between the buyer and seller.

The buyers and sellers may negotiate a number of provisions in a reservation clause. For example, will the seller retain all or just a specific portion of the mineral estate?

Will the seller reserve all minerals or just certain minerals? Will the seller retain all executive rights? Will there be any limitations on drilling? If the reservation clause involves anything more than a very basic, simple reservation clause, the broker will likely need to suggest that the parties seek the assistance of counsel who can draft an appropriate addendum to the contract.

A broker will not want to move into the unauthorized practice of law by drafting a complex legal clause or addendum. What is a royalty? It is a share in the production. Royalties are typically expressed in fractions e.

However, they can be stipulated in other ways. Royalties can be sold separately from other mineral interests. The owner of a royalty retains the right to receive the royalty under an oil and gas lease; but the royalty owner may not necessarily be the mineral owner. Many times mineral owners will sell rights to royalties or they may retain rights to royalties when selling their interest.

There are various types of royalty interests e. The common elements of a royalty are: He and the buyer blame each other, and both want the earnest money. What should I do? Remember, there are two ways to formally terminate a contract:. The parties can agree to terminate and sign a document like Release of Earnest Money TAR that releases both parties from further obligations under the contract.

Here is an example: The buyer may terminate the contract at any time until 5 p. The buyer will retain the earnest money. The contract was effective at execution. Even though the sale is subject to the approval of the lender, there is still a contract between the buyer and the seller. The effectiveness of the contract is not subject to lender approval, so the effective date should be filled in as with all contracts.

The addendum makes it clear that the contract is binding upon execution by the seller and the buyer, and that the earnest money and option fee must be paid as provided in the contract.

A MUD is a political subdivision of the state that's authorized by the Texas Commission on Environmental Quality to provide water, sewage, drainage, and other services within its boundaries.

The seller is required by the Texas Water Code to provide notice to a buyer that the property is located within a MUD prior to the buyer entering into a sales contract. The notice must provide information regarding the tax rate, bonded indebtedness, and fees, if any, of the MUD. Usually, the fact that the property is within a MUD should be fairly obvious to the seller because it will be listed on the tax bill that the county sends to the property owner.

However, the seller will not always know what specific type of notice to provide to the buyer based on the requirements in the Water Code. If the MUD is not in city limits but within the extraterritorial jurisdiction of the city, use the notice in If the MUD is in neither, then use the notice in You have two options for obtaining copies of the notices.

MUDs are required to file these notices with their county property records office, so you may request a copy from the county. To look up a district's information, including the contact information for the district's agent, use TCEQ's online database of utility districts. In this situation, the second offer, once accepted, can be a back-up contract only. According to Paragraph B of the A ddendum for Sale of Other Property by Buyer , the seller may not compel the first buyer to waive the contingency or terminate the contract under the addendum until the seller accepts a written offer to sell the property.

The seller may not accept a second offer unless the back-up addendum is part of the second offer. Otherwise, the seller may be obligated to sell to two different buyers, especially if the first buyer waives the contingency. The TREC residential forms and the TAR forms are silent as to the reservation or exception of any mineral interests or royalty interests. Under those forms, the seller has, therefore, agreed to convey all interests in the property, including the mineral interests unless such is specifically excluded otherwise by a special provision or addendum.

In the TREC Farm and Ranch Contract form, Paragraph 6E provides space for the owner to specify the exact documents that evidence exceptions. Exceptions should be referenced by the specific recording data.

Paragraph 2F of the same form contains a few lines for the seller to reserve minerals or other interests to himself. What is an oil and gas lease or a mineral lease? In exchange for compensation specified in the lease, the lessee is given the right to search for, develop, and produce the oil and gas or minerals.

Commonly, the industry states that the lessee "works" or "operates" the interest leased because he performs the work.

The lease can encompass the right to work all the minerals or only those specified in the lease e. What can my buyer do to get her earnest money? Following these steps for disbursement releases the escrow agent from liability related to the disbursement. This might make it easier for the buyer to recover the liquidated damages stated in Paragraph Although the amount of earnest money involved in any given transaction may not be substantial, a party who wrongfully fails or refuses to sign a release could end up liable for more than just the amount of the earnest money held by the escrow agent.

The buyer also has a right to re-inspect the property at reasonable times, according to the contract. A seller who refuses to permit inspections at reasonable times would be in breach of the contract.

The parties may establish in writing the effective date. My buyer client asked me to explain the Mediation Paragraph in the One to Four Family Residential Contract Resale before she submits an offer on the form. TREC recently revised its contracts to change the requirement to mediate from optional to mandatory.

Buyers and sellers must now attempt to resolve any contract-related dispute through mediation before going through the court system. There are two factors to consider. First, the seller has agreed in the listing agreement between the seller and the listing agent to sell the property for the stated listing price. Technically speaking, if a ready, willing, and able buyer presents an offer for the listing price as advertised in the MLS and the seller refuses or is unable to accept the offer because the seller cannot cover the difference, the listing broker's fee has been earned and is payable.

It is perfectly foreseeable that a hearing panel could find a member in violation of the code if that member advertises a listing price in the MLS with the full knowledge and understanding that the seller is unable to accept offers at that price. Which form is the appropriate form to use?

Updated April 29, It depends on whether you have a sales transaction or a lease transaction. Use this form any time a TREC or TAR contract form is used in the sale of a property with a dwelling built before This form is for lease transactions only. Ask the listing agent for the effective date of the pending contract.

This date will go in the first blank. This determination is similar to determining the value of any other asset. Namely, what is the price at which a willing seller would agree to sell, and what is the price at which a willing buyer would agree to buy? This requires a familiarity with transactions involving mineral interests and royalty interests and current market prices for such interests.

One should contact an expert to make this determination. What is a mineral? However, the definition of a mineral is broader than oil and gas and can include uranium, sulfur, lignite, coal, and any other substance that is ordinarily and naturally considered a mineral. My seller client has an executed contract with a buyer. After the buyer completed his inspection during the option period, the buyer asked my client to make several repairs and to use a repairman the buyer chose. Updated July 9, No.

Note that the Completion of Repairs and Treatments Paragraph in TREC contracts requires the seller to either use someone who is licensed to make the repairs or, if no license is required by law, the seller must use someone who is commercially engaged in the trade of providing such repairs—unless the buyer and seller agree otherwise in writing.

It means the seller must use a licensed electrician unless there is a written agreement between the buyer and seller to use that unlicensed handyman for electrical repairs. The termination option ends at 5 p. The Texas Real Estate Commission revised its contracts effective January 1, , to implement this time deadline.

The date of receipt of the escrow agent is evidence that the effective date of the contract is, most likely, on or before that date, but is not conclusive as to the effective date. Can you explain the language in Paragraph 7D of the One To Four Family Residential Contract Resale TAR , TREC ? New language in Paragraph 7D of the One To Four Family Residential Contract Resale TAR , TREC became mandatory Sept.

TREC Broker-Lawyer Committee member Dawn Moore offered the following explanation of the change. To prevent a potentially fatal contract-drafting error, TREC approved a change to Paragraph 7D of the One To Four Family Residential Contract Resale. Paragraph 7D establishes the agreement between seller and buyer as to one of the material terms of the contract: In order to bind the seller to the buyer, the buyer must make a firm offer complete with all material terms to which the seller can agree.

If the buyer has no repairs in mind when making the original offer, the buyer checks Paragraph 7D 1. If the buyer knows of a specific item that needs repairing either because it's visible, shows up on the seller's disclosure, or is otherwise disclosed to the buyer prior to inspections , the buyer checks Paragraph 7D 2 and inserts the specific repair. During the option period, the buyer may submit an amendment to either provision.

If the seller does not accept the buyer's amendment, the buyer may terminate the contract. Paragraph 7D 2 calls for specific repairs. If the agent fills in anything other than a specific repair, TREC sees it as the agent practicing law without a license.

This contract is an "as is" contract with an option. This answer would apply to identical language in Paragraph 7 of all of the other TREC contracts except for the New Home Contract Incomplete Construction.

If a higher offer from another prospective buyer is received after a short-sale contract has been accepted by the seller but before the lender approves the first contract, should the second offer be accepted by the seller using the backup addendum? My client is selling a commercial building, and today he received an offer submitted on the Commercial Contract-Improved Property TAR He wants to accept the offer, but he asked me to strike out the paragraph that requires him to deliver estoppel certificates to the buyer because the only tenant occupying the property is on a month-to-month basis.

Can I cross out part of the existing contract language? Updated August 19, Yes, but only as specifically directed by your client. Your client should put his instructions to you in writing and specifically state what changes he would like to be made.

You should advise your client to contact an attorney for legal advice about the effect of striking out contract language. Paragraph 21 of the TREC contract requires that all notices from one party to another must be in writing. TREC has promulgated the Notice of Buyer's Termination of Contract form for use when a licensee is helping a buyer provide the appropriate notice to the seller of the exercise of his termination option.

While a buyer can use any form of written notice to terminate the contract, a buyer's agent asked to help the buyer give the appropriate notice should use the promulgated form. When the appropriate box of the form has been checked, the TREC Notice of Buyer's Termination of Contract form makes it clear that the buyer intends to and is giving the appropriate notice to the seller of his election to terminate the contract under the provisions of Paragraph While one might believe that the buyer has made the decision to terminate the contract under his termination option by sending the seller or his agent a signed Release of Earnest Money form, showing the earnest money being released to the buyer and indicating a release of all rights or liabilities under the contract, a court might not agree that this writing satisfied the buyer's notice requirements under Paragraphs 21 and 23 of the contract.

The preferred practice would be for a buyer's agent to have a buyer who intends to exercise his termination option under the provisions of Paragraph 23 use the TREC Notice of Buyer's Termination of Contract form and send the signed form to the seller at the address specified in Paragraph 21 or by facsimile as specified in that paragraph.

The Release of Earnest Money form could be signed and included with the notice form to facilitate the execution of that form by the seller. This same procedure of sending both the TREC notice and the release of earnest money form to the seller can be used when the buyer is giving notice to the seller of the termination of the contract under any paragraph of the contract or any contract addendum. Why would a buyer of property in or near an urban area care if the seller conveys or reserves mineral interests?

The mineral interests may be of value to the buyer. The buyer will also want to know if there is a possibility or likelihood that an operator will need to use all or part of the surface that the buyer controls. The buyer will also want to know if there is a possibility or likelihood that an operator will place a well or other machinery on or near the property and whether the operator may need to cross the property. How does a landowner determine the extent of the minerals or royalty interest he owns?

The owner will need to consult with an expert, such as oil and gas attorney or landman, to make this determination. Some title companies may, for a fee, provide this service.

What is a mineral interest? The owner of a mineral interest owns all or part of the mineral estate. The owner of the mineral estate typically holds the right to search for, develop and produce minerals from the property. A mineral interest can be severed from the surface rights and can be sold or leased separately from the surface once it is severed from the surface.

Usually, the owner of the mineral estate holds the right to use the surface to the extent that is reasonably necessary to extract the minerals implied easement. Just as one may have multiple owners of the surface, there may be multiple owners of the mineral interests.

Each mineral interest holder may have different rights. The holders of the mineral interests together own the mineral estate. A buyer made a full-price offer, but my client decided not to sell. A seller is not bound to accept any offer, even at full price. However, your seller could be in breach of your listing agreement by refusing to accept the full-price offer.

Payment of the option fee is not a notice. Rather, the payment is a performance requirement if the buyer wants to have an option period. Paragraph 23 details the time for that performance, stating that if the buyer fails to pay the option fee to the seller within three days of the effective date of the contract, the buyer does not have an option period. Paragraph 23 emphasizes that time is of the essence and that strict compliance with the time for performance is required.

Since Paragraph 23, the Termination Option Paragraph, uses the word within when describing the time period, Day One of the option period is the day after the effective date of the contract.

If your client wishes to terminate under the Termination Option Paragraph, she must provide notice to the seller by 5 p. In this case, the effective date is the date the buyer is informed that the seller accepted the offer. Doesn't presenting the second offer to the lender in this manner place the lender's interests above those of the seller? I represent a seller whose existing survey has one number for the square footage while the appraisal district has another number.

How should I report this to potential buyers? Use the Notice of Information from Other Sources TAR to report this information. Whether an item of personal property has been so permanently attached as to constitute realty is a question of fact. Juries consider three factors when determining whether personal property has become real property:.

Will the property damaged by removal? If so, to what extent? Is the item customized for the property, or is it standard? Was the installation intended to be permanent or temporary? The party's intention is the predominant factor, while the first two factors constitute evidence of that intention. Testimony of intention will not prevail, however, in the face of undisputed evidence to the contrary. A number of factors probably contribute to the cause. The increased price of oil and gas, better technologies for finding and extracting oil, and the increased growth of our cities are variables that, taken together, may be part of the cause.

The material provided here is for informational purposes only and is not intended and should not be considered as legal advice for your particular matter. You should contact your attorney to obtain advice with respect to any particular issue or problem. Applicability of the legal principles discussed in this material may differ substantially in individual situations. Any legal or other information found here, on TexasRealEstate. Skip to Content Skip to Navigation. Careers in real estate TAR governance Officers Executive Board Board of Directors Bylaws Local associations Association jurisdictions Map of TAR regions Local board roster.

Does my client have to pay for a new survey in this instance? My client bought a vacant lot in a neighborhood years ago and never built on it. Now he wants to sell the lot. Which listing agreement should I use to sell the property? My client received an offer on her home in which the first box in Paragraph 3B is checked indicating that the contract is not subject to the buyer being approved for financing. However, the buyer attached a completed TREC Third Party Financing Addendum to the contract.

What should we do with this offer? My seller is closing next week, but will stay in the property for 30 days after closing under a temporary lease. Does the buyer still get a set of keys at closing? My client received an offer on his home. Does my client have to respond in writing? Updated March 4, No. The buyer then signed the disclosure notice, acknowledging receipt. Do the buyer and seller have to sign the information form, too? My seller received a written offer to purchase his property. Instead of countering the offer in writing, the parties engaged in verbal negotiations that resulted in a verbal agreement on new terms.

Now, the first buyer is threatening to sue my client for breach of contract because of their verbal agreement. Is the verbal agreement enforceable? Under what conditions would the seller check the box in paragraph 7C to show that the seller's disclosure notice is not required? Now that both the Farm and Ranch sales contract and the One to Four Family Residential Contract Resale sales contract require the TREC Addendum for Reservation of Oil, Gas and Other Minerals if a seller wants to reserve a mineral interest, can I use the One to Four Family Residential Contract Resale form for the sale of a acre tract that has a home on it and is located just outside of town?

Is it appropriate to fill in one of the sections of the TREC Third Party Financing Addendum TAR with something like market in the space for the maximum interest rate permitted for the loan contingency or to leave the percentage amount blank for the maximum loan fees permitted for the loan contingency?

Do the Texas seller's disclosure requirements and the federal lead-based paint regulations apply to residential foreclosure properties built prior to ? He gave me his earnest money check and now the contract is fully executed. When do I have to deposit the earnest money with the escrow agent named in the contract? I submitted an offer on a home for my client and included the Third Party Financing Addendum for Credit Approval for a conventional loan.

What can my client do? I represent buyers who are interested in purchasing a home and want to ask the seller to pay for part of their closing costs. They intend to use conventional financing instead of FHA financing, so there will be no FHA-prohibited fees. Where does the broker disclose whom the broker represents? Can the lack of the lender's underwriting approval of the property still result in the termination of the contract even though the time has already passed for the buyer to give notice to terminate the contract under the Third Party Financing Addendum?

A buyer and a seller agree that the seller will pay for the survey under Paragraph 6C 1 of the TREC contract. My client wants to enter into a lease-purchase agreement with a prospective tenant. A former client's attorney prepared a lease-purchase agreement similar to what my current client needs. Can I make changes to the agreement so it's applicable to my client's transaction? A checkbox in the form asks whether the property is located in a Texas agricultural development district.

What does this mean? Updated April 24, The process for creating agricultural development districts was enacted in by the Texas Legislature to promote the development of agricultural facilities that result in employment and economic activity.

She also wants to request that the seller contribute to closing costs.

Option fee (Texas) - Wikipedia

What is the best way to prepare the offer with these terms? Updated June 30, Since the parties haven't agreed on the termination of the contract and no judge has decided the issue, you shouldn't give either party advice about the termination of the contract. My client's listing is a home on a acre tract.

A buyer's agent submitted an offer for his client on the One to Four Family Residential Contract Resale. My client is concerned that the residential form won't address the outstanding mineral interests, but the buyer's agent says he often uses this form for situations such as this and his client is OK with using that contract. Does the use of that form instead of the Farm and Ranch Contract make any difference? Updated November 5, Yes. The landlord has decided not to renew his month-to-month lease anymore.

Updated March 11, Yes. Updated Oct 16, The parties to the contract should consider several factors before deciding what contact information should be inserted in Paragraph A seller under a listing agreement wants me to take her property off the market.

Do I have to terminate the listing to do this? Updated April 11, In this situation, you can use Amendment to Listing TAR Why would a seller want to retain mineral interests in a sale of property in or near an urban area?

I see that Paragraph B of the Addendum for Back-Up Contract TAR is for the contingency date when the first contract has to terminate or else the back-up contract terminates. What date should I put here? Can you give an example of determining the effective date? By presenting a second offer to a lender prior to the lender making a decision on a first contract, is the listing broker compromising his fiduciary duty to the seller because the seller's negotiating position with the lender has been damaged?

Follow-up to above question regarding earnest money and contract termination: After my buyer completed his inspection, he sent the seller an amendment to ask for several repairs. If the effective date is not filled in, does that mean that there is no contract? Updated June 4, No.

How do I determine the effective date? Four elements must be satisfied for final acceptance to take place: Should the second offer not be accepted by the seller until the lender has an opportunity to either accept or reject the first contract? I represent a buyer who wants to purchase a home that is for-sale-by-owner. The owner tells me he will pay me a fee if he signs a contract with my buyer and that contract closes. Is there a form I can use to secure my fee?

I am confused about the effective date in TAR's commercial contracts. The TREC contracts provide a place to insert the executed date of those contracts, and this date is defined in the contract as the "Effective Date. May 6, The commercial contracts address the matter of the effective date in paragraph Are the seller and listing broker obligated to submit the second offer or back-up contract to the lender though the lender has not yet accepted or declined the first contract?

If the broker uses a TREC residential contract form, may the broker add a simple reservation clause with respect to the minerals in special provisions? Is it really necessary for the buyer to pay an additional option fee to extend the option period? Remember, there are two ways to formally terminate a contract: A judge can order a contract termination. When calculating the time for performance under the promulgated forms, is the effective date included as the first day?

Can the buyer still terminate the contract after the option period because of these issues? Was the contract effective at execution, or will it be effective when the seller obtains lender approval? I've heard that a seller whose home is located in a municipal utility district, or MUD, is required to give a buyer special notices.

What are the notices, and where can I find them? The seller must choose from three notices, based on the location of the MUD: If the MUD is located within city limits, use the notice in A seller is under contract to sell his property.

The Addendum for Sale of Other Property by Buyer is attached to the contract. A second buyer makes an offer. Should the Addendum for Back-Up Contract be used when negotiating the second offer? How are mineral and royalty interests addressed in the TREC contract forms and the TAR commercial contract forms? Does a buyer have to complete his inspections during the option period?

If the broker fails to insert the effective date, may the parties later execute an amendment that establishes the effective date? Are listing agents permitted to list a property in MLS for less than what is owed by the seller in an attempt to entice offers, even though the seller cannot accept full-price offers due to the his inability to cover the difference between the full price offer and the amount owed on the property?

My client wants to submit a backup offer on a home that already has a contract pending. How do I get the information I need to prepare the backup addendum? Updated July 16, Ask the listing agent for the effective date of the pending contract.

How does one determine the value of the mineral interest or royalty interest he owns? If the broker fails to insert the effective date, may the parties rely on the date that the contract is delivered to the escrow agent as the effective date? After completing inspections on one of my listings, the buyer requested the seller repair several items shown on the inspection report. The seller refused to do any of the repairs. During the option period, I received a Release of Earnest Money form TAR signed by the buyer and his agent showing the earnest money being returned to the buyer.

No Notice of Buyer's Termination of Contract form TAR has been received by the seller or the listing agent.

Does the Release of Earnest Money form satisfy the buyer's notice of termination requirements under Paragraph 23 of the contract? How does Paragraph 21, which states that notices can be effective when mailed, affect payment of the option fee under Paragraph 23? Would the answer have been the same, if there had been no buyer's agent and, instead, the buyer was working directly with the listing agent? How do you determine if an item is "permanently installed and built-in" with regard to Paragraph 2 of the One to Four Family Residential Contract?

Juries consider three factors when determining whether personal property has become real property: Get Involved Member Benefits Continuing Education Research. About Us Contact Us News Releases Association Governance.

Our Impact Issues What You Can Do Advocacy.