When to buy stocks vs bonds

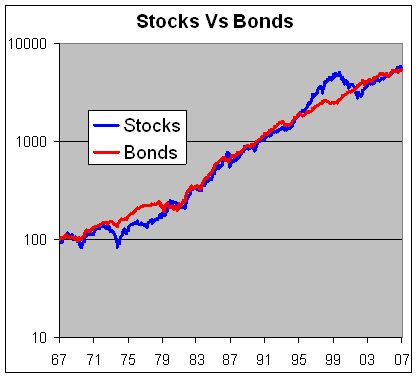

Many of us are or were taught in economics about the counterrelationship between stocks and bonds in investments. Usually when an investor is seeking diversity, a portfolio will include a mix of stocks and bonds for this traditional adversarial relationship. The story usually goes that when the stock market is in a bull run, the bonds go bearish, meaning that the demands for bonds goes down as stocks rise, making prices for the bonds g down and yields go up in an attempt to attract business.

The opposite is usually true in a bearish stock market. When there is uncertainty or it looks like the market is taking a negative turn due to poor economic news, investors tend to invest more in bonds, which drive the prices up and sends yields down.

However, for at least the last two to three years of the Obama administration, there have been some mixed messages to the point that tradition was broken and the stock and bond markets both trended the same — bear to bull and back again. The question is often whether to buy stock in private but publicly traded companies, or to buy bonds created from federal or state governments?

Bonds vs. stocks (video) | Stocks and bonds | Khan Academy

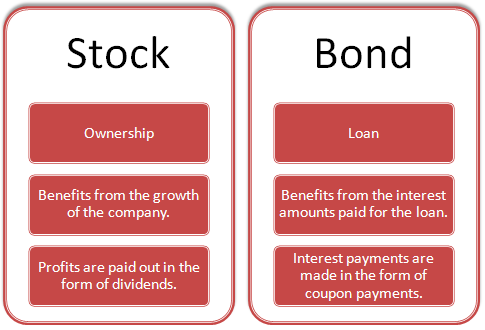

It makes sense that stocks and bonds would be adversarial in a yin-and-yang sort of way. Stocks are shares of a company — a person who invest in Apple, for instance, essentially owns a piece of the company.

STOCKS vs. BONDS: THE CIVIL WAR | ronoxivipyr.web.fc2.com

If you own Apple stock, you are a co-owner of that company. And if you own the company or want to buy some ownership, that usually means you are bullish about that company. You are betting that your optimism in that company will be well-founded and that you will make money on that bet.

Stocks vs Bonds - Difference and Comparison | Diffen

When the company is doing well, more and more people will want that stock, and as there is no unlimited supply of stakes, the shares that are on the market become fewer and the price goes up. And if you hold your stake long enough and then sell at or near the peak, you can make yourself some money.

While companies also sell bonds, stories about stocks vs. Bonds are essentially IOUs from the when to buy stocks vs bonds to those who buy them — it is a promise that if you give the government money on this bond, the government will pay you interest on a regular schedule based on the coupon interest rate posted on the bond, until the date that the bond matures.

And you get your initial investment returned to you at that time, provided you hold the bond at the date of maturity. While taxpayers may not like the federal government offering so much debt every year, investors in a way love it.

The Great Rotation: Investors buy stocks, ditch bonds - Dec. 19,

Federal debt is backed by the federal government, so it is a very reliable investment. The current argument is not really about whether the economy will grow under Trump — the overwhelming consensus is that it will, based on his call for fewer regulations and lower taxes, never mind the sticky tax-reform talk — it is about how fast that growth will come.

Those on the bond side say the growth will be a little farther down the road, and in fact thre may be more bond-buying opportunities in the next 12 to 18 months, because reduced regulations will take a little while to appear in the economy, and taxes at this point the great depression stock market crash in 1929 not seem to be changing much and the effect may not be felt until later this year at the earliest.

Any glimmer of optimism is enough to push stocks higher — the market is more of an optimism gauge for the future than a current state of the economy.

They think it will be the same with Trump, and jump on board now! That is a difficult question to answer. There is no crystal ball, and with the way the economy has transformed and evolved over the last 20 years, what has traditionally been true in the markets and the economy could be completely obsolete and off-base this time. There seems to be optimism on the whole that the economy will improve could it get worse, honestly?

But how fast will the turnaround happen remains to be seen, and how large will the growth be is also hard to predict. From an investing perspective, you should have both stocks and bonds in your portfolio if you want to be truly diversified, but if you agree that growth will happen soon, then stocks are a good way to go. Sign me up for the newsletter! Home Personal Finance Markets Politics Sports. Log into your account.

Home Markets STOCKS vs. Dollar Hovers Near One-Month High Despite Political Risks.

How To Invest In Stocks And Bonds For BeginnersNext article Financial Planning: RELATED ARTICLES MORE FROM AUTHOR. Boston Omaha Corp BOMN IPO. Bezos Is Uniquely Positioned. LEAVE A REPLY Cancel reply. Please enter your comment!

Please enter your name here. You have entered an incorrect email address! Boston Omaha Corp BOMN IPO June 20, Bezos Is Uniquely Positioned June 19, We provide you with the latest breaking news and videos.

POPULAR CATEGORY Markets 65 Politics 16 News 16 Personal Finance 10 Markets Featured 5 Sports 3 Personal Finance Featured 2. Privacy Policy Terms of Service Contact.