Put call parity american call option

If an underlying doesn't pay dividends for our purpose defined as any distribution to the underlying's holder directly or indirectly e. In particular, I'm thinking of bond options like the year Treasury Note.

Clearly options like these are worth more but how much more and what factors are required to evaluate put-call parity? There is an interesting article entitled American Put Call Symmetry from the mid 90s that might be what you want.

By posting your answer, you agree to the privacy policy and terms of service.

Put-call parity clarification (video) | Khan Academy

By subscribing, you agree to the privacy policy and terms of service. Sign up or log in to customize your list.

Hughes Optioneering

Stack Exchange Inbox Reputation and Badges. Questions Tags Users Badges Unanswered. Quantitative Finance Stack Exchange is a question and answer site for finance professionals and academics.

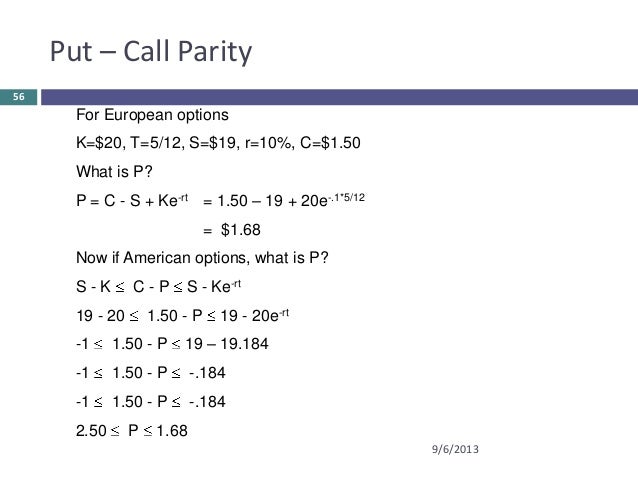

Join them; it only takes a minute: Here's how it works: Anybody can ask a question Anybody can answer The best answers are voted up and rise to the top. What changes to put-call parity are necessary when evaluating american options on non-dividend paying assets?

In the book, the derivation is left as an exercise. Derek Ploor 1 2 Jeff Burdges 1 7. Sign up or log in StackExchange.

Sign up using Facebook. Sign up using Email and Password. Post as a guest Name.

Put-Call Parity

In it, you'll get: The week's top questions and answers Important community announcements Questions that need answers. Quantitative Finance Stack Exchange works best with JavaScript enabled. MathOverflow Mathematics Cross Validated stats Theoretical Computer Science Physics Chemistry Biology Computer Science Philosophy more 3. Meta Stack Exchange Stack Apps Area 51 Stack Overflow Talent.